There are two entry methodologies I use:

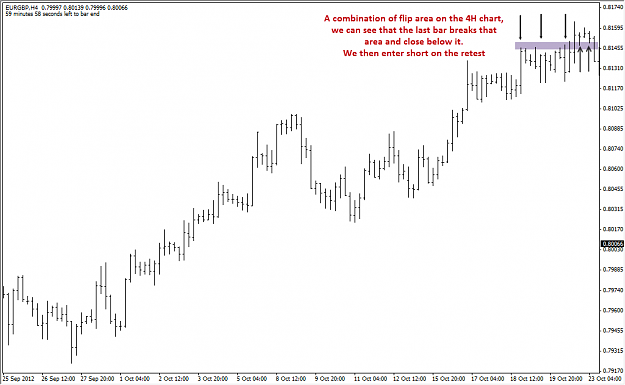

1. A break of flip between support and resistance areas, the higher the time frame, the better.

I first wait in order to see that the flip area was indeed broken, if that's the case, I enter on the retest to that area.

Those flip areas are an aggregate of bar lows and highs.

Here is an example:

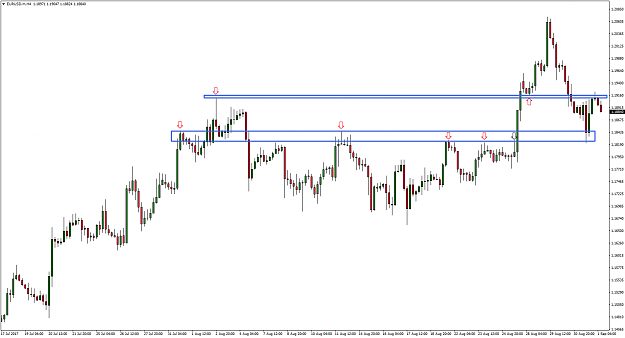

Here is the retest (price had retest that area twice, so in fact we had two opportunities going short):

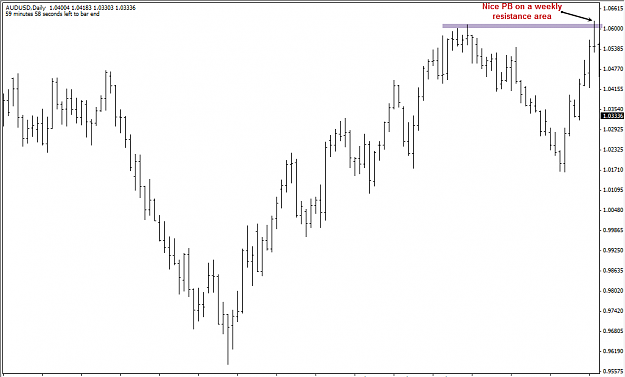

2. A break of a candlestick pattern called a PB and an OB. you will see and read in other places the a PB is also being called as inverted hammer or a Pinocchio bar,

but the meaning from the price action point of view is the same. you can Google and read about this further.

I must add that those patterns must occur on a resistance or support area in order for me personally to trade it.

Here is a nice example for a PB on the daily chart with a great location on a weekly resistance level

Remember, we are going short only after the pattern will be broken:

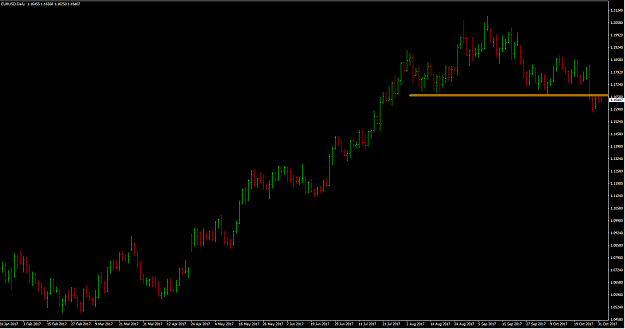

Here is where we can see what had happened after the pattern had broken, you can see that this move gained us a nice ROI to our account (no matter where you had closed the trade).

1. A break of flip between support and resistance areas, the higher the time frame, the better.

I first wait in order to see that the flip area was indeed broken, if that's the case, I enter on the retest to that area.

Those flip areas are an aggregate of bar lows and highs.

Here is an example:

Here is the retest (price had retest that area twice, so in fact we had two opportunities going short):

2. A break of a candlestick pattern called a PB and an OB. you will see and read in other places the a PB is also being called as inverted hammer or a Pinocchio bar,

but the meaning from the price action point of view is the same. you can Google and read about this further.

I must add that those patterns must occur on a resistance or support area in order for me personally to trade it.

Here is a nice example for a PB on the daily chart with a great location on a weekly resistance level

Remember, we are going short only after the pattern will be broken:

Here is where we can see what had happened after the pattern had broken, you can see that this move gained us a nice ROI to our account (no matter where you had closed the trade).