I am sharing the simplest strategy for stress free day trading, I have ever seen anywhere else

Indicators

Indicators

- SMA 5,0

- BB (Optional)

Time Required - Just 15 minutes daily after D1 close when new candle starts.

Avoid

- Lower timeframe charts, even H4 is not reliable.

- Risk - Do not take positions more than 5% of account value and do not take multiple positions of same currency (Max 2), even setup is 100% correct

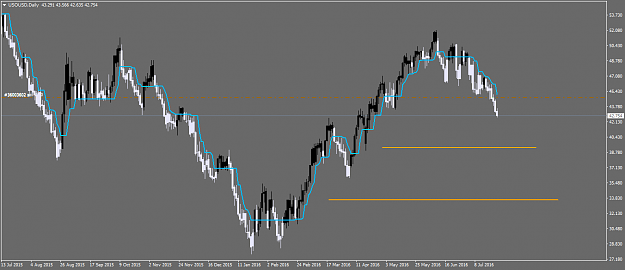

- Sideways pattern, see below

(Updated on 17-Dec-2016)

- Long - SMA line in upward direction

- Short - SMA line in downward direction

- Ignore - Flat SMA line

Entry

- Long - When previous D1 bull candle's body has clearly crossed SMA and did not touch BB upper band.

- Short - When previous D1 bear candle's body has clearly crossed SMA and did not touch BB lower band.

Please refer #4572 for some examples http://www.forexfactory.com/showthre...17#post9162217

Stop Loss

- high(+15 Pips)/low(-15 Pips) of previous candle, if candle is too short then you may move to T-2 candle.

Take Profit/Exit

- Take 2 positions of same setup, and close the first setup after taking profit on same day and leave the another setup to run forever

- Keep moving SL for second setup as per S&R

- You may exit when candle touches/cross BB top/bottom line.

- You may exit from second position if you have minimum 3 candles profit as part of 1:3 strategy.

- Must Exit on breakeven if setup goes in opposite direction.

I request all of you to try and share your results regardless positive or negative, here is why

- Traders will be motivated when they see your positive results

- Traders will stay away if they see your negative results

- Suppose all traders try this strategy, it will force setup to follow the direction we want

- we will be helping traders who were never profitable

- we will be helping retired/jobless person to make money

- we will be helping new traders to survive in the market and list goes on...

You may try this strategy on old charts, Good luck!

Disclaimer : USE OF THIS THREAD/SUGGESTIONS AT YOUR OWN DISCRETION AND RISK AND YOU WILL BE SOLELY RESPONSIBLE FOR ANY LOSS!