Hello, traders!

I would like to tell you my brief story.

I have been studying, namely, understanding (there is no a teacher I can study under) the stereotypes of crowd behavior in the market for the last two years. Due to an idea that the market crowd generally makes mistakes and market-makers profit just from the losses incurred by the crowd (housewives), I came to a conclusion that I will take the side of the market-makers and start earning with them, if I trade against the crowd.

Many of you might think now that there is nothing new in it, since such an idea as sentiment trading has been in existence for a long time and virtually everybody heard about it. However, which of you studied it for more than two years, like I did? Thus, I think that I have something to tell you.

Besides, I give you a guarantee that you will not start earning money immediately after reading the article, since you need to have the market perception different to a classical one. It takes days, weeks and months to have the perception. You didn't hope that you come to the market, open a trading terminal and start making money, didn't you? If so, how much money must make everyone who has been trading for long?

Unfortunately, I cant (perhaps, I just don't want) idealize my strategy, like many other people do it, so I tell you at once that it is not a Holy Grail system. However, I can guarantee that you will at least stop losing your money, if you start applying my methods even in a combination with your strategy currently being used.

If you hurry to start earning, then you certainly came to the wrong place. If you are a persistent and a stubborn man, like I am, you are welcome! Lets start.

Trading against the crowd. This is how I call this method.

A time-worn phrase caused me to be a follower of the method: "If all signals indicate that its time to sell, all analysts tell you with one voice about a nice short position, and you see "Sell now" sign everywhere, then you need to muster up your strength, make an effort of will and press the Buy button".

Let me mention at once that it is not a usual indicator-based strategy that enables you opening trades based on red and green arrows, but it requires using your brains a little. You will have to analyze every market situation from scratch.

So, the trading against the crowd strategy is a trading method that implies opening trades in the direction opposite to the opinion of the majority of traders.

A question arises at once: How shall we know or where can we get data on the opinion of the majority?

Given the fact that Forex is a decentralized market, there is no a single source of data on the market sentiment anywhere. You will have to collect the data from various sources and, just as important, rank them by their weight.

- We can collect the market sentiment data from various brokers. Many of them provide a so-called "traders open positions ratio". Each of you might have seen such pictures:We shall discuss how to use it a little later.Attached Image

- Besides, at the moment there are two brokers, which provide fully-featured order books displaying all open positions and also limit-orders and stop-orders placed by their clients.

- Analytics and news. These two types of publications are usually have a losing nature. Do you think if all those traders who read about recommendations to buy in the news would be allowed to earn? No, they would not, since the modern market is different. All those who read the news will more likely bring profit to smarter players.

- As a last resort, you can visit a thread of any trading forum, a chat or a blog, where people discuss a currency pair of your interest. If you see that all traders forecast an uptrend, you should look at short position closely.

I named those particular sources I know the best, but it doesn't mean that there are no other sources.

Ideally, the order book like that offered by Oanda or Saxo Bank, but covering all Forex brokers, will be the best indicator of the market crowd sentiment. Notice that I highlighted the word brokers. In this case we really take a interest in data just on all brokers, but not the entire Forex market, since brokers provide data mainly on minor players and very successfully filter out positions opened by major players.

I suppose that you have caught the meaning of my words a little at the moment. It is more likely that you have questions or counterarguments now. However, I prepared myself for it in advance (my web-site has another language version, through which traders asked me these questions many times) and shall provide answers to your questions beforehand. Perhaps, I shall update the answers after a while.

By the way, I often receive skeptical and imprudent feedbacks in response to all my efforts to share knowledge/methods. It is usually hard for a man to discover something useful from other peoples words especially in the case of the Forex market. Though it is much more easy and interesting to criticize somebody or attempt to pleasure ones own ego. This is the reason why I wrote such a large text to prove my knowledge of the subject matter. You must admit that if I posted several images and wrote one paragraph of text, you would more likely not read the article.

FAQ

Here you can read the most frequent questions and counterarguments related to the given method.

Why must the strategy work?

Perhaps, you know that various funds and banks come to the Forex market not only for the purpose of currency exchange, but also for making an additional profit by means of speculations. Even major corporations are not above the speculations, when they usually convert their revenue from one currency into another one.

Besides, these banks and funds can have a temporary influence on pricing due to the volume of their transactions. Now ask yourself the question: Who is more likely to win: you or a bank/a fund? I suppose the answer is self-evident. Now imagine that there are many people like us and we look like randomly moving plankton owing to the absence of communication between us. Some of us move up, other ones move down.

What do you think will happen to the chaotic mass of the plankton, if a whale (a major player) comes in view? The whale will eat all of them: both moving up and moving down.

The trading against the crowd strategy is almost the same as following a market-maker. All successful day trading strategies are based on the following a major player.

After all, where is the money, which notorious 95% of traders lose? Do they fall into the hands of the rest 5%? No, they don't. They fall to the hands of market-makers.

Data from one broker are not sufficient, since one broker does not represent the entire Forex market.

You might have heard of such term as exit poll. That's when sample surveys are held and preliminary voting results are provided before announcement of official results during elections. Exit poll results vary from real election results very slightly in the majority of cases.

The same effect is true in this case. Lets assume that 10,000 people trade through some broker. If 60% of them buy Euro, then the same percentage of all traders (60%) in the entire Forex market will more likely buy Euro too.

In fact, we accept a representative sample of data from a particular broker. Moreover, we get data from several brokers: it increases weight of our data.

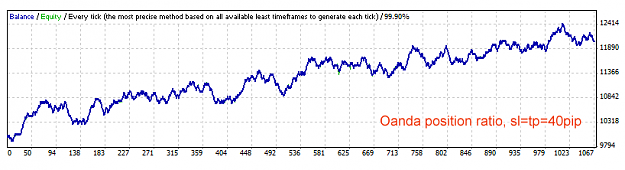

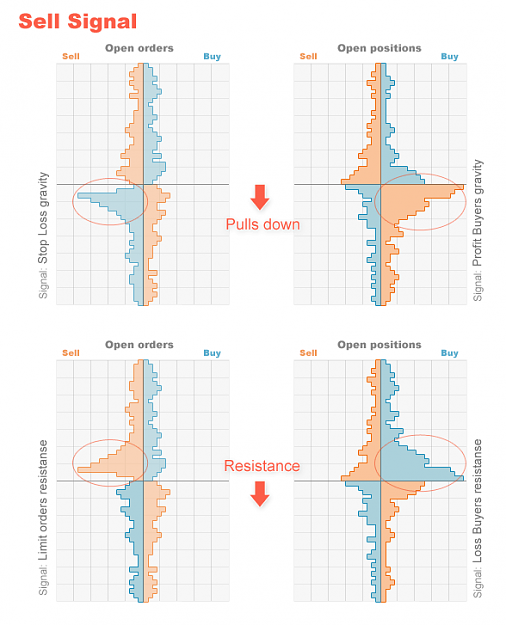

Just look at these backtesting results:

Do you say that data from one broker are not sufficient?

P.S. I selected 40 points as a stop-loss and a take-profit size to illustrate a profitable regularity in case of a large number of trades. Actually a stop-loss of 120 points fits much better the given strategy.

Brokers can fudge data and provide false data

Yes, they can.

However, we can filter out liars thanks to stereotypes of the crowd behavior.

You may not believe me, but we can accept data even from a scam broker, which doesn't submit transactions of its clients to the real market. Communication with the rest of the market crowd is performed by behavioral stereotypes inherent to all small traders. Ill tell you more about the stereotypes a bit later.

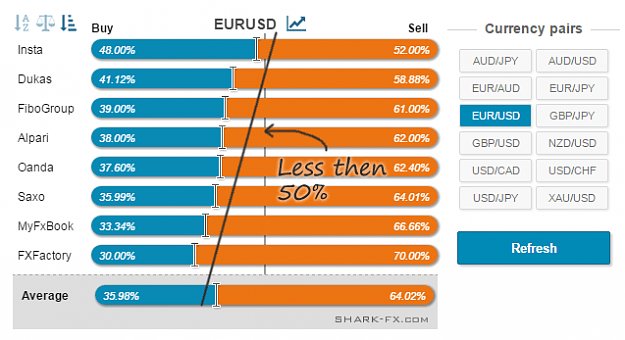

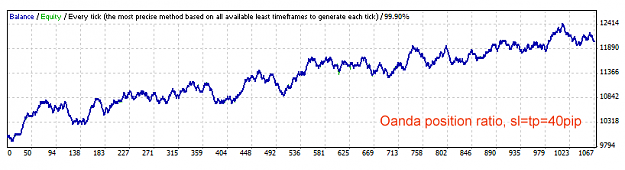

Take a look at the current percentage ratio of open positions:

All brokers take one side. If some broker fudged data, we would find it out.

What is better to use: number of traders or lot size?

Opinions are usually divided on the issue. Some traders think that the right thing is to calculate number of traders and others that lot size is a more important thing.

Personally, I consider that lot size is of greater importance. However, it doesn't greatly matter as a whole, since the ratio data are very similar. Look at the ratio bar even here at FXFactory. Data on number of traders and lot size differ slightly and rarely generate opposite signals.

What will happen, if this strategy really works and everyone start using it?

No, they wont start. A propaganda machine promoting Fibonacci, Bollinger and other indicators works much more effectively than my "useless arguments".

I can see an increasing number of sources of the market sentiment data in the future, but I don't exclude a slight degradation of their performance.

It is not so easy to employ the strategy profitably. Even most of those who read this will give up midway.

What will happen, if brokers remove shared access to their ratio data?

Applying the given method produces the right market perception, which is a very valuable experience. Nowadays I can often predict the ratio data just looking at the chart and not looking at the ratio data after 2 years of applying the method. However, I feel more comfortable, when I use the data, of course.

That is all about the questions. Lets proceed to the rules of the strategy itself.

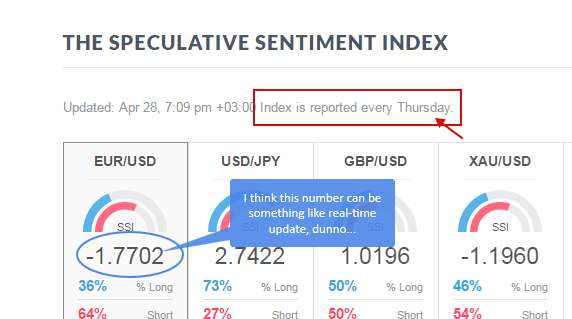

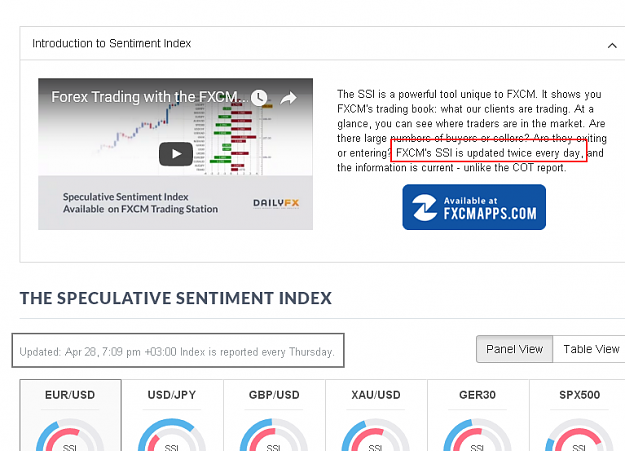

Ratio signals (SSI)

Ratio is a percentage value showing the current difference between the amount of traders, which have opened trades to Buy and Sell a currency. At that, already closed trades don't affect the indicator readings.

Ill clear up a point: a percentage value of long positions is shown on the chart. Total percentage value of short and long positions is equal to 100%. Therefore, you can easily calculate a percentage value of short positions by subtracting a percentage value of long positions from 100%.

Long-term ratio signal

According to a long-term strategy, a market entry signal is generated, when the percentage ratio of positions opened through the majority of brokers is in favor of one side (for example, a number of buyers is much more than that of sellers). At that, you should trade towards the direction opposite to the opinion of most traders. Such a signal can last from several months up to a year.

Lets consider the situation on the example of the ratio of open positions on EUR/USD:

We can see from the picture that if the percentage ratio of Buy or Sell open positions is higher than that of the opposite open positions, it acts as an excellent indicator of trend. Therefore, by opening a position against the crowd, you open it in the direction of trend.

Benefits of the strategy:

- Like any long-term strategy, it is easy-to-use;

- Minimum costs in time;

- Trade mainly with trend.

Weaknesses of the strategy:

- It doesn't work on all financial instruments. As for the metal market, Buy trades dominate over Sell trades. As for AUD/JPY, Buy trades (carry trade) also prevail over Sell trades. In addition, the strategy produces weak signals for lightly traded currency pairs.

- It doesn't provide you with particular entry/exit points, but only shows the right direction for future trades.

- The strategy itself is raw, so I recommend using it coupled with more accurate strategies.

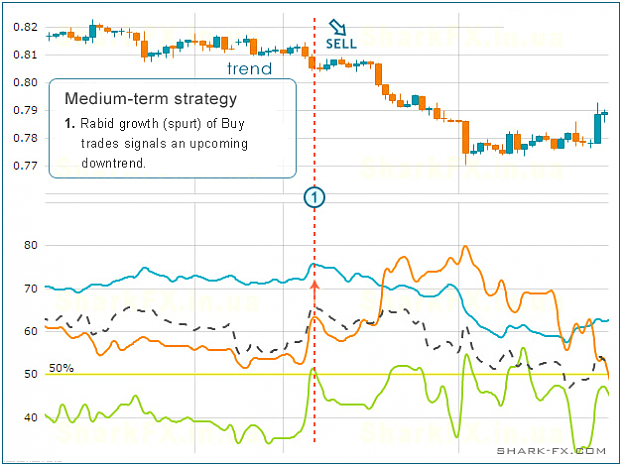

Medium-term ratio signal

The core of the strategy is a searching for violent fluctuations of value of the percentage ratio of open positions. A significant change of the value to one side (bearish or bullish) for most of brokers is of interest to us. As with the previous strategy, we shall search for entry in the direction opposite to a spurt.

Lets consider an example of such a spurt on NZD/USD pair:

Spurts of this sort are nothing but inflow of smart money into the market. By creating favorable conditions, they make the crowd to buy, while accumulating the opposite position at that time. I think it is no longer a secret for you that trades placed by major players are not displayed on the chart of the percentage ratio of open positions. This is the reason why the spurt appears on the chart.

Benefits of the strategy:

- It produces efficient signals.

- It implies trading with trend.

- It includes signals produced by the long-term strategy.

Weaknesses of the strategy:

- You need to wait for a long time for signals to appear.

- It doesn't provide you with particular exit points.

There is also a short-term ratio signal that requires using an order book, which the following section is devoted to.

Profit ratio signals

Profit ratio is a percentage ratio of traders, which are currently profitable.

The average Profit/Loss ratio amounts to 25-40% profitable/60-75% losing traders.

Imagine that the number of profitable traders has increased up to 50%. What does it mean? It means that price moves in the wrong direction, and reversal will more likely occur.

How to analyze it: If the profit ratio (black line) breaks out of a green area, it serves as a reversal signal.

Trade direction can be defined with a lower chart. If most of profitable traders are buyers, we should sell, and vice versa: if most of profitable traders are sellers, we should buy.

We should set take-profit at the level of a grey line called RP.

RP is a price level, at which the profit ratio will take its minimum value, which is possible at the moment. For example, the profit ratio equals 42% for now, but it will take a value of 28% at the RP level.

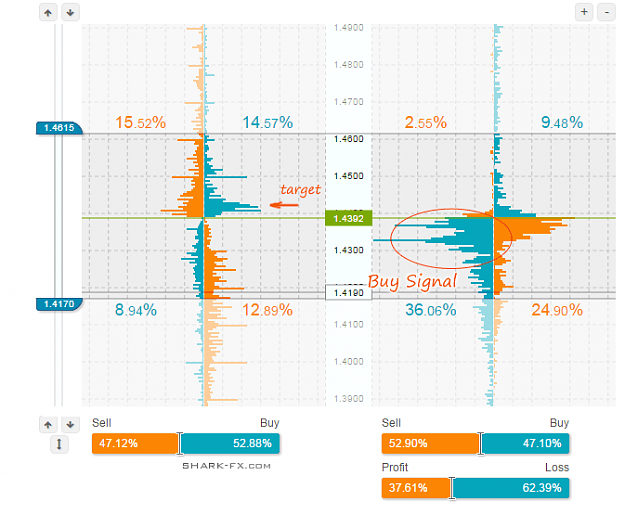

Order book signals

Thanks to Oanda for such a nice and a unique tool. The only strange thing is that other brokers don't follow its example.

Basic signals generated by the order book are based on aggregation of various orders: limit orders, stop orders or already opened positions.

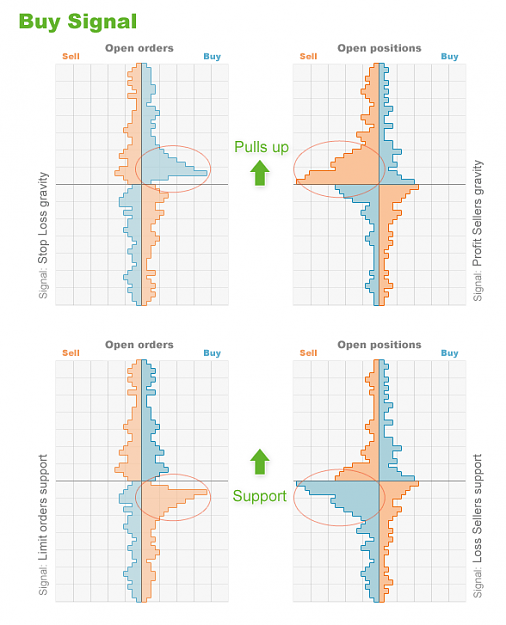

I prepared a small cheat sheet on basic patterns, which can be recognized in the order book.

For Buy trades:

For Sell trades:

For all simplicity of these patterns there are too many nuances, which, unfortunately, I cannot tell you, even if I write a whole book.

I shall try to provide practical examples in the future. However, you will have to learn by yourself how to apply these tools against the market crowd profitably. I repeat once again: you must admit that it would be too easy, if you can start making money immediately after reading the article

Conclusion

Now I'm going to tell you about several more nuances to conclude the article.

- I wouldn't like anybody to try to automate the strategy even in spite of those nice profitability charts provided above. If I haven't developed an EA until now, then it is not so easy to accomplish the task. The fact is that there are too many nuances, and one pattern can produce both bullish and bearish signals at different situations.

- You need to give up a classic interpretation of the market and believe in some "conspiracy theory" stating that the market always runs against the crowd.

- Usually I open 2-3 trades based on these signals per week. If you trade more often, it means that you attempt to see something that doesn't really exist.