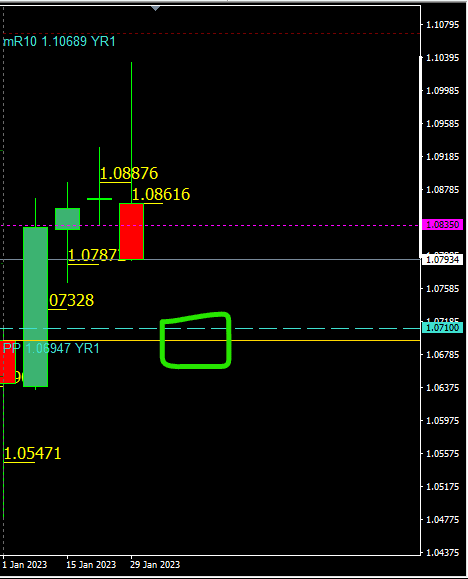

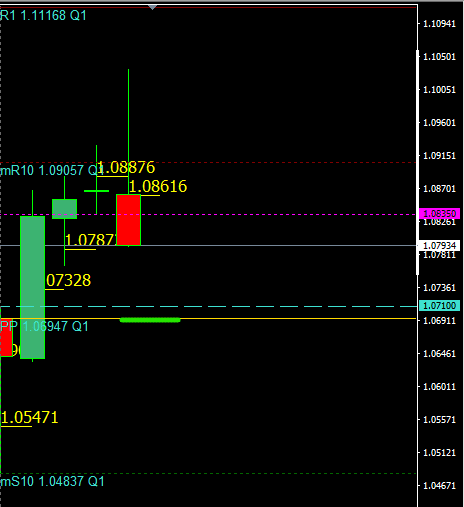

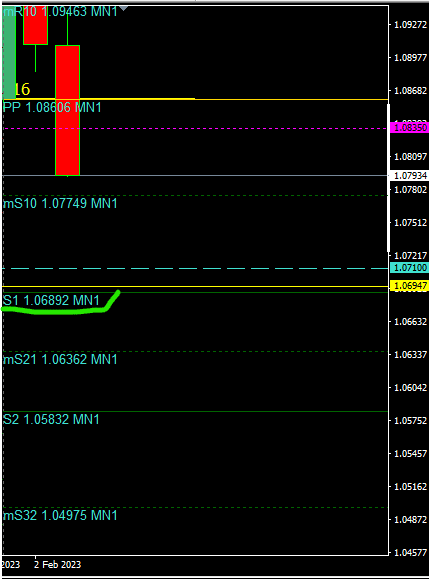

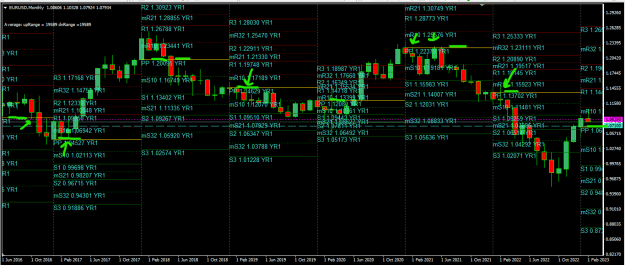

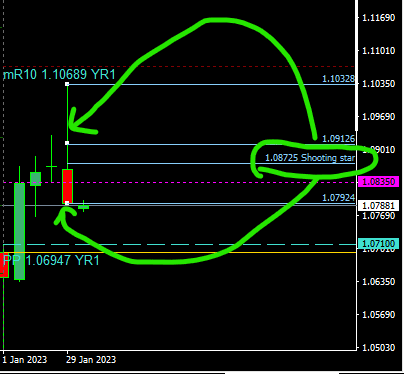

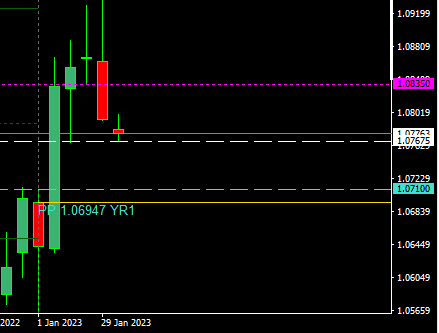

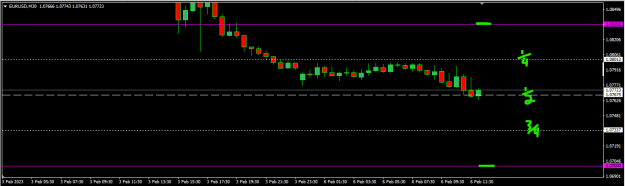

DislikedAm feeling so bad and down today...I had euro shorts after fomc at 1.0950 and 1.0972.. it went all the way to 1.1034 during asia session... I booked loss at 1.1000 thinking it wil support and go to 1.11 or 1.12 during ecb Booked loss as scared loss will be more if jumps and wipe account .. Now today I see cost came on Thursday US session and today would have been bumper profit .it's at 1.0794 almost 200 pip profit ALWAYS this happens in euro when I book loss position comes in cost next day andmore profit later But if I hold position with loss.it...Ignored

1