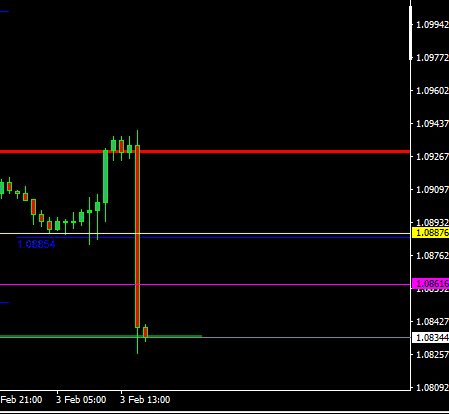

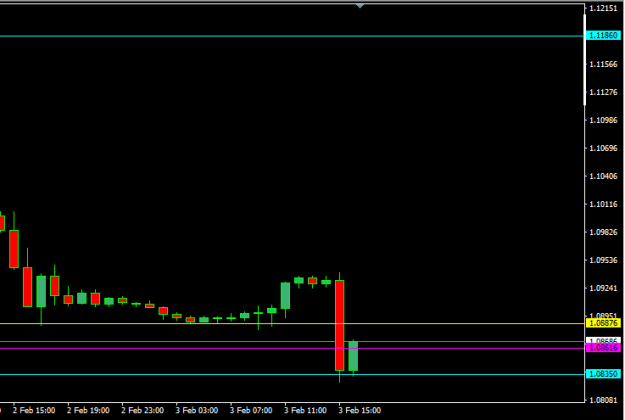

Disliked6h just gave me a possible target 1.1039+. Sl 1.0867. I got a entry window using that target and the draw to 1.0874x. Its about 7.5 pips of risk. The 4h closes in 2 hs. Its bullish side is about 1.0822 close. If its below, chances for 1.0874x should increase a little. Its inside the 6h risk window.Ignored

those who can, do. those who cant, talk about those who can