Using multiple time frames and getting different signals...

So Im getting a bit frustrated with my trading.

Using mutiple time frames is supposed to help with seeing the bigger/smaller picture but what it does for me is often give me conflicting signals in my trading.

I may have a sell on the 5 min but a buy on the 15 and a wait and see on the hourly.

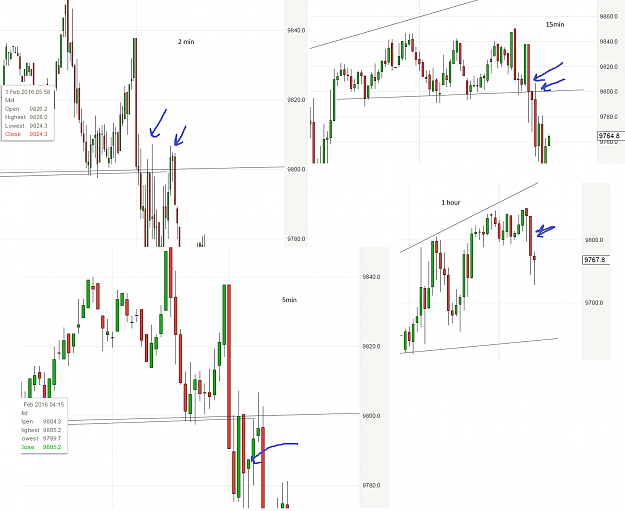

Example; this morning ...

As the dax opened the 2 min was showing a breakout to the downside but then looked like it was going to reverse. The 5 min at first showed breakout to the downside but then put a hammer down and again looked like it was going to head back up.

The 15 min looked like the trendline was holding so showed reverseal is coming the hourly wasnt done printing.

This is just an example so dont get hung up on the particulars but I just wanted to show this.

What I end up doing is giving each time frame credence and trading accordingly but then my trading gets confused when I dont know which way its heading but I dont want to miss out so I keep trying to 'guess' ahead of the move - what happens is I get wipsawed and I miss what I originally thought was the right trade.

So this trade I Sold; then bought because thought we were heading up but then resold but got stopped out. Now out of the market and see that the dax continued down as I originally thought.

So how do you look at mutiple time frames without getting 'confused'?

Often it looks like the signal points one way on one time frame but another with the other time frame.

I tend not to use squiggelies on my charts but look at trendlines and support and resistance.

Suggestions?

So Im getting a bit frustrated with my trading.

Using mutiple time frames is supposed to help with seeing the bigger/smaller picture but what it does for me is often give me conflicting signals in my trading.

I may have a sell on the 5 min but a buy on the 15 and a wait and see on the hourly.

Example; this morning ...

As the dax opened the 2 min was showing a breakout to the downside but then looked like it was going to reverse. The 5 min at first showed breakout to the downside but then put a hammer down and again looked like it was going to head back up.

The 15 min looked like the trendline was holding so showed reverseal is coming the hourly wasnt done printing.

This is just an example so dont get hung up on the particulars but I just wanted to show this.

What I end up doing is giving each time frame credence and trading accordingly but then my trading gets confused when I dont know which way its heading but I dont want to miss out so I keep trying to 'guess' ahead of the move - what happens is I get wipsawed and I miss what I originally thought was the right trade.

So this trade I Sold; then bought because thought we were heading up but then resold but got stopped out. Now out of the market and see that the dax continued down as I originally thought.

So how do you look at mutiple time frames without getting 'confused'?

Often it looks like the signal points one way on one time frame but another with the other time frame.

I tend not to use squiggelies on my charts but look at trendlines and support and resistance.

Suggestions?