Greetings, I andi ahmad Yusuf stayed the province of Lampung, Indonesia sorry if my English language is less good .I will try to explain the strategy that I use in trading valas.saya grateful for input later and we are still together learning.

technique or strategy is very risky and not in the recommendation by many fellow traders in the province saya.oleh therefore I call this strategy TN.HOP in Indonesian (tn = Teknik Nekat) HOP= High risk of Open Positions

This strategy is a combination of fundamental and technical analysis techniques, because I think candlestick formed as news and economic conditions of a country;

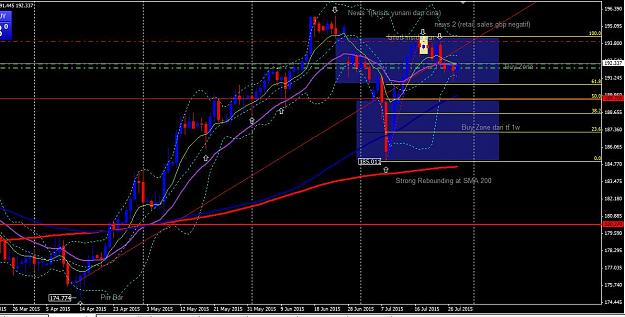

I use analytical techniques such as; price action and reversal or rebounding

indicators in pairs; SMA / EMA 200, SMA / EMA 80, BB 12, EMA 21 and EMA 8

currency in the recommendation: GPB / JPY (because of rapid movement) certainly very risky

Time Frame is used: 1W, 1D, 4H, 1H, 30M, 15M (later on I will explain why use a lot of the time frame)

there may be colleagues who wish to respond please

technique or strategy is very risky and not in the recommendation by many fellow traders in the province saya.oleh therefore I call this strategy TN.HOP in Indonesian (tn = Teknik Nekat) HOP= High risk of Open Positions

This strategy is a combination of fundamental and technical analysis techniques, because I think candlestick formed as news and economic conditions of a country;

I use analytical techniques such as; price action and reversal or rebounding

indicators in pairs; SMA / EMA 200, SMA / EMA 80, BB 12, EMA 21 and EMA 8

currency in the recommendation: GPB / JPY (because of rapid movement) certainly very risky

Time Frame is used: 1W, 1D, 4H, 1H, 30M, 15M (later on I will explain why use a lot of the time frame)

there may be colleagues who wish to respond please