Disliked5 second is so fast i am still in screen time mode on that.

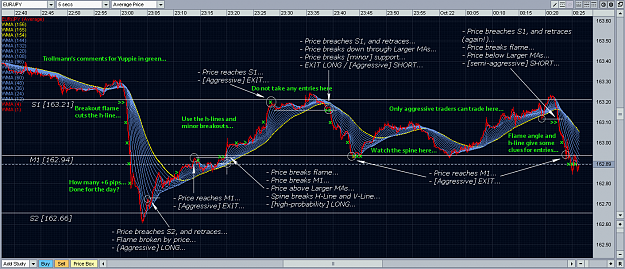

I am using Oanda demo for charts and EFX for trading. I have found the eur/jpy to be a little to fast. So I am concentrating on the pair that I position trade the AUD/USD

Has anyone else had probs trading the eur/jpy? I don't know why on the aud and euro making 20 -30 and losing on a couple is a much easier task then euro/jpy, on that i am always getting my ass kicked!

another point is aud/usd brokerage is only 9.40 in and out compared to 14$ on the eur/usd and eur/jpyIgnored

Today I have traded the AUD/USD in the London-session for the first time and it was not disappointing. So in the future I'll track and research the AUD/USD and maybe I'll dedicated myself to this pair.

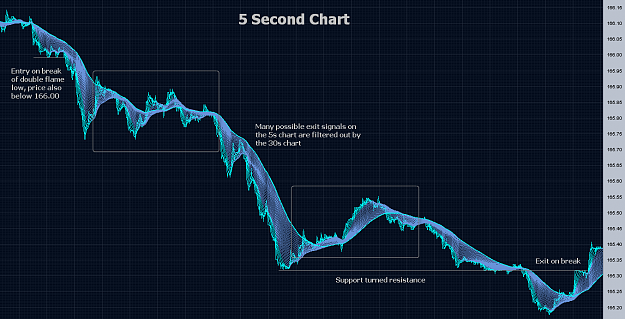

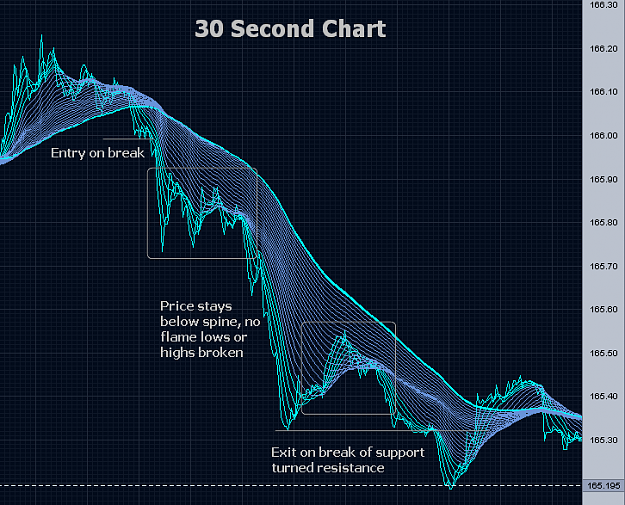

I have some problems with the EUR/JPY, especially on Friday and when the market is slow. EUR/JPY is (very) fast, so I'll jump-in to late on the 5 sec chart. But that's only my fault. AUD/USD seems to fit me on 5 sec for my daily pip-target.

Time will tell...