The below is a post I made at another thread (except I added a little more to it here). Nobody responded to it and so I decided to make it into its own thread. The reason I made the post into this thread is because the subject matter is SO important to those of us that have a goal of getting rich in forex (I assume all of us would like our forex trading to make us rich). Even though I've been involved in forex trading since 2005 (and a member here since 2006), I have only dabbled in it during all this time and taken demo trades only - but even then only every once in a while and not on any consistent basis during these past 9 years. Therefore please understand I spent all that time focusing on trading systems and trading strategies. I spent ZERO time on the financial details of forex, such as "margin requirements" and "leverage". So, now, after all these years I'm finally getting serious about trading with actual money because I feel confident enough in my trading system. Anyways, below is the post I made in another thread and I felt it was important enough to re-post it here into its own thread:

I've been lately thinking about this whole "margin requirement" mess. So let me get this straight: If I compounded my profits to, say, about $25,000.... wouldn't the margin requirement be SO huge that it would be very difficult for most people - including me - to be able to afford the margin requirement? In my situation, a possibly exists that my EA might take as many as 10 trades at one time. Therefore, my guess is that I would need an additional $25K - $50k in my trading account just to cover my margin requirement! And the larger your account grows, the more additional money you will need to cover your margin requirement? Am I basically correct in my assessment?

With the above in mind, then how in the world can most people hope to get rich in forex if the margin requirement will be VERY huge... assuming the trader is skillful enough to grow his account substantially? Am I correct in saying that no matter how much you grow your account, you will always need access to a substantial amount of money in order to cover the larger margin requirement as your account grows? Unless a person is already rich, then they most likely don't have an extra $25K, $50k, or whatever amount to cover their margin requirement when their account grows (assuming the person is able to grow his account to a large amount of money).

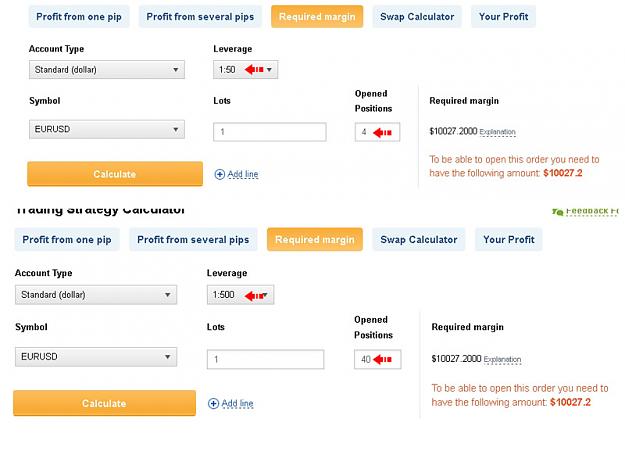

Due to the fact that the United States brokers are limited to 50:1 leverage, does that cause the margin requirements to be higher for us American citizens? Do citizens in countries outside the U.S. have it easier in regards to margin requirements ... due to the luxury of having 200:1 and 400:1 leverage ratios? Or does the leverage not affect the margin requirement whatsoever? I have a hunch that the limit of 50:1 leverage is the REAL culprit here. Is leverage actually the MAIN problem for U.S. traders and not the margin requirement itself?

Is everything I say above basically true - meaning it will be impossible for most people to afford the margin requirement at some point (once they build their account to a large amount of money)? Or, am I just confused about this entire issue of margin requirement for large trading accounts?

Can anyone confirm my fears of what I have written above? Or at least give your opinion about the possible difficulty of trading an account with a large margin requirement / low leverage?

I've been lately thinking about this whole "margin requirement" mess. So let me get this straight: If I compounded my profits to, say, about $25,000.... wouldn't the margin requirement be SO huge that it would be very difficult for most people - including me - to be able to afford the margin requirement? In my situation, a possibly exists that my EA might take as many as 10 trades at one time. Therefore, my guess is that I would need an additional $25K - $50k in my trading account just to cover my margin requirement! And the larger your account grows, the more additional money you will need to cover your margin requirement? Am I basically correct in my assessment?

With the above in mind, then how in the world can most people hope to get rich in forex if the margin requirement will be VERY huge... assuming the trader is skillful enough to grow his account substantially? Am I correct in saying that no matter how much you grow your account, you will always need access to a substantial amount of money in order to cover the larger margin requirement as your account grows? Unless a person is already rich, then they most likely don't have an extra $25K, $50k, or whatever amount to cover their margin requirement when their account grows (assuming the person is able to grow his account to a large amount of money).

Due to the fact that the United States brokers are limited to 50:1 leverage, does that cause the margin requirements to be higher for us American citizens? Do citizens in countries outside the U.S. have it easier in regards to margin requirements ... due to the luxury of having 200:1 and 400:1 leverage ratios? Or does the leverage not affect the margin requirement whatsoever? I have a hunch that the limit of 50:1 leverage is the REAL culprit here. Is leverage actually the MAIN problem for U.S. traders and not the margin requirement itself?

Is everything I say above basically true - meaning it will be impossible for most people to afford the margin requirement at some point (once they build their account to a large amount of money)? Or, am I just confused about this entire issue of margin requirement for large trading accounts?

Can anyone confirm my fears of what I have written above? Or at least give your opinion about the possible difficulty of trading an account with a large margin requirement / low leverage?

"Trading is a mental sport." - Ziad Masri