A little about me

-23 years old

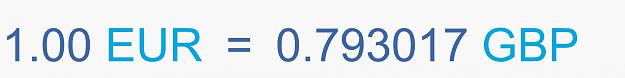

-Deep understanding of FX liquidity

-Trading FX since Oct 2011

A little about my journey to riches

-400% per annum goal

-Started account March 10, 2014 (the one in this explorer)

A little about this thread

- will post positions and limit orders with charts (but sorry I will not share chart specifics')

- will post strategy for the setup (risk % and potential drawdown)

A little about my trading

- monthly swings (huge money')

- daily swings (big money)

- 4 hour (small money)

- cost basis tradinf

- very rarely use tight stops, they are highly speculative.

will add more this later, just wanted to get it posted

will add explorer too

currently just cashed AUDNZD (weekly) longs 1.0990. Buy dip and go for 1.1190

holdinf EURJPY (weekly) EURGBP (monthly') and EURAUD (weekly) longs

holding NZDUSD (daily) longs to 8550 after cashing 8831 shorts

holding USDCAD (monthly') longs from 1.0640

-23 years old

-Deep understanding of FX liquidity

-Trading FX since Oct 2011

A little about my journey to riches

-400% per annum goal

-Started account March 10, 2014 (the one in this explorer)

A little about this thread

- will post positions and limit orders with charts (but sorry I will not share chart specifics')

- will post strategy for the setup (risk % and potential drawdown)

A little about my trading

- monthly swings (huge money')

- daily swings (big money)

- 4 hour (small money)

- cost basis tradinf

- very rarely use tight stops, they are highly speculative.

will add more this later, just wanted to get it posted

will add explorer too

currently just cashed AUDNZD (weekly) longs 1.0990. Buy dip and go for 1.1190

holdinf EURJPY (weekly) EURGBP (monthly') and EURAUD (weekly) longs

holding NZDUSD (daily) longs to 8550 after cashing 8831 shorts

holding USDCAD (monthly') longs from 1.0640

Be hopeful in a winning position, and fearful in a losing position.