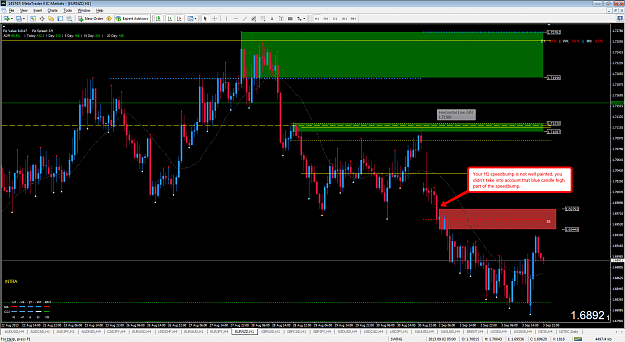

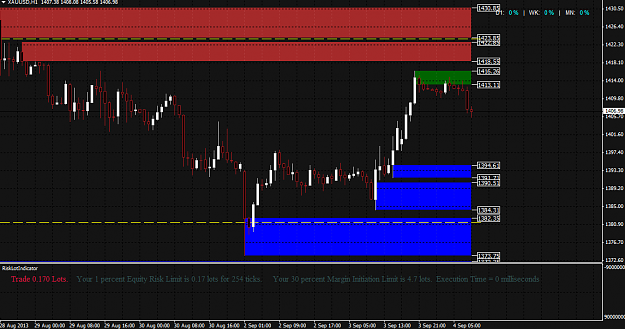

Disliked{quote} This is why Sam Seiden likes good arrival also though Alfonso does not use it is because a strong arrival means strong orders backing the move. If there are enough orders we may see a barely touch or even come a few pips short of the zone. If the orders are higher in the zone we many times will see a false break of the Distal (the issue of when is a zone removed which I am still working through) to get the higher up (or lower down) orders and to also bring in the break out traders so...Ignored

QuoteDislikedSam has many videos on this also and his way differs from what Alfonso shows. My biggest frustration with this is more the lack of trades and this is something I am working through. I watch these bases form and most of the time price never comes back and if...

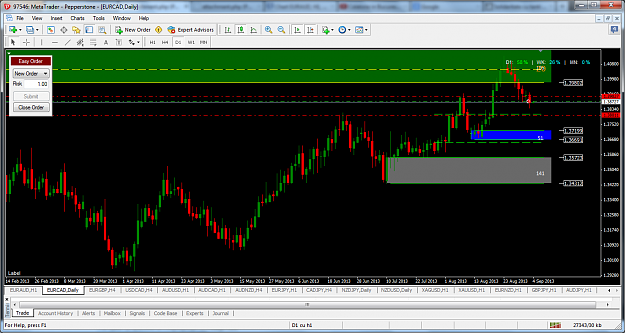

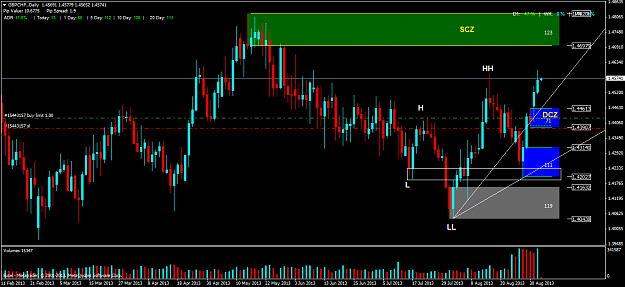

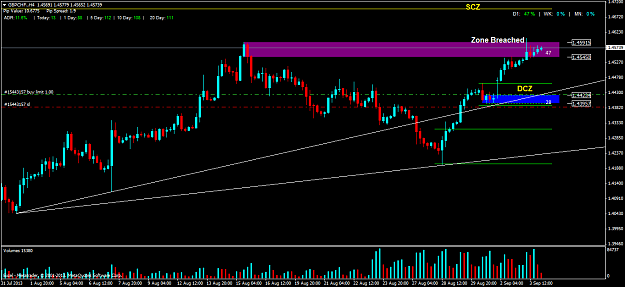

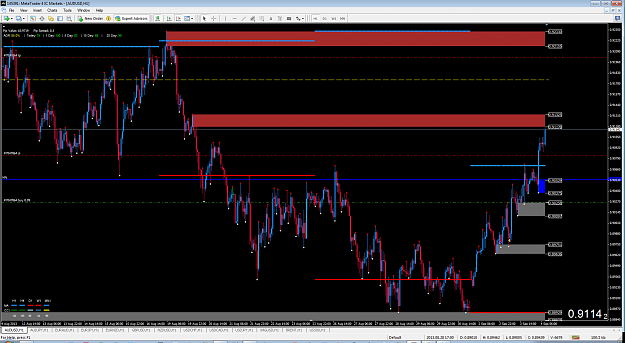

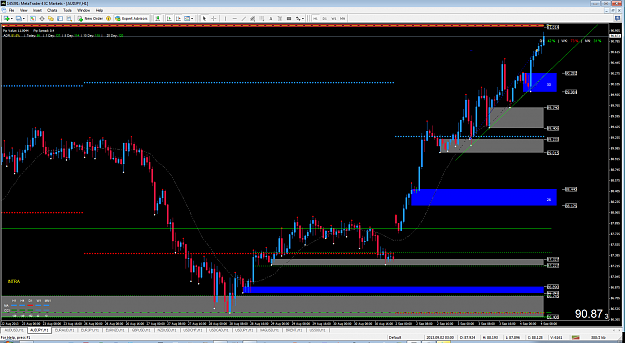

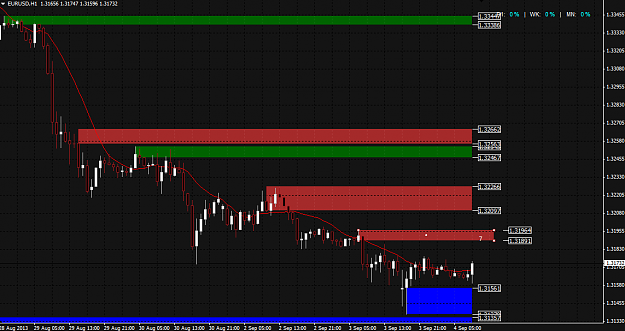

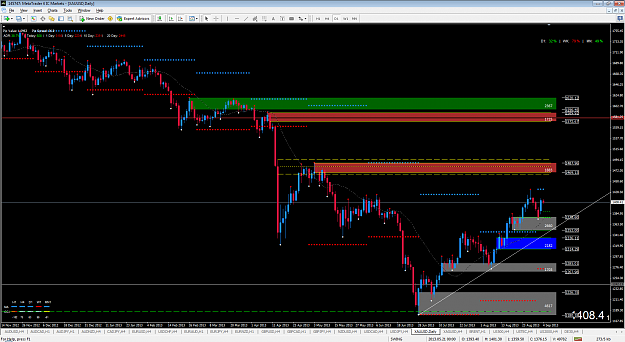

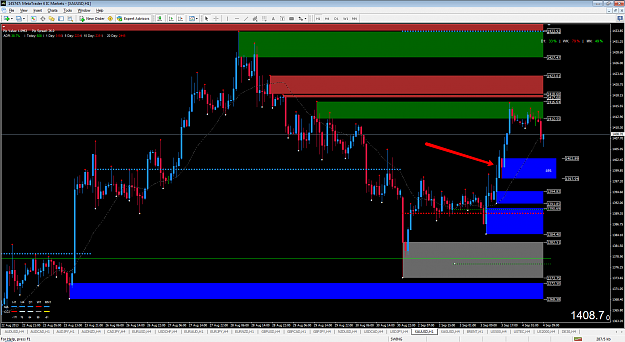

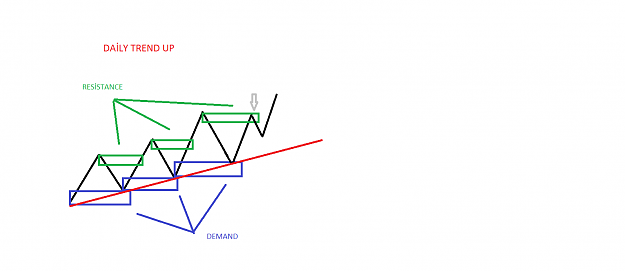

I do trade à la Sam Seiden, as shown on his videos. The thing is that I've seen him say things and doing the opposite on other videos. I decided to start my journey on SD trading and I eventually had to add some nuances, create the indicators you know, because I realized that there are many more opportunities strictly based on SD levels than waiting for the big imbalances. That's why some of my trades differe a bit, but the core system is the same. Why have I added those nuances? Because I've forward tested and it works, that's the only reason. Would I be taken live trades that I've not fully forward tested? Not at all, I would be silly doing that.

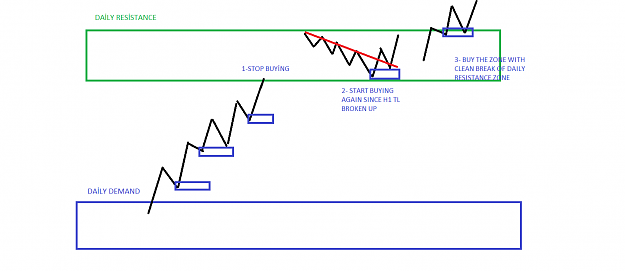

I love the strong imbalances, if there is a fresh and original one on an untested D1 supply, I will have an order sitting there. But, if prices does not make it there and drops without me riding that trade, why should I wait for that level if there are new lower levels go short at? That's where the middle-strong or not as strong levels idea come in, as long as we're high in the curve for trading, trendline is being respected and we're far from good original demand areas.

That's the whole logic. Is it easy? No, it's not. It takes time, like everything in life, but it's worth the effort. Patience and forward testing it yourself is key!

Hope that helps!

Alfonso

Set and Forget supply and demand trading community