Disliked{quote} I've found this last webinar enlightening like no other as it has cleaned many bits and bobs which usually confuse intermediates like me, it indeed was a direct hit.Thank you very much!

Ignored

- Post #5,756

- Quote

- Jun 26, 2015 4:59am Jun 26, 2015 4:59am

- | Commercial Member | Joined Aug 2011 | 3,541 Posts

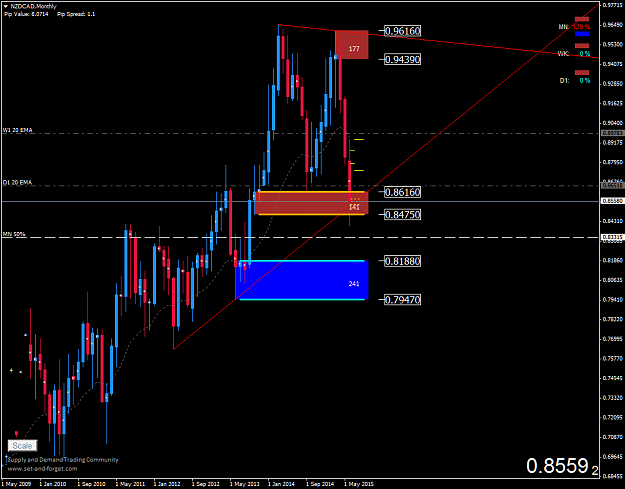

Set and Forget supply and demand trading community

- Post #5,757

- Quote

- Jun 26, 2015 5:00am Jun 26, 2015 5:00am

- | Commercial Member | Joined Aug 2011 | 3,541 Posts

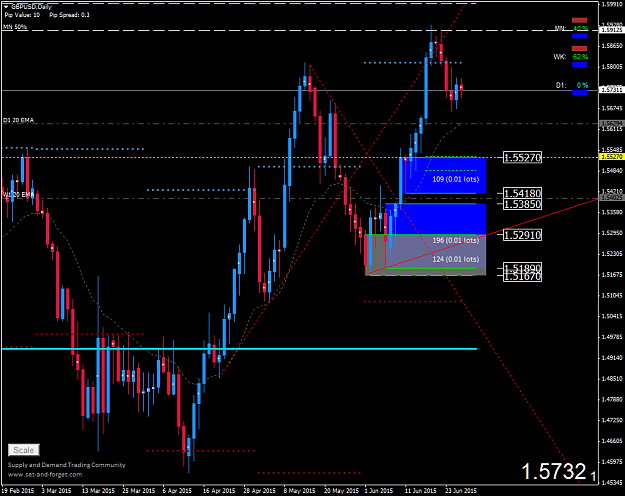

Set and Forget supply and demand trading community

- Post #5,758

- Quote

- Jun 26, 2015 5:01am Jun 26, 2015 5:01am

- | Commercial Member | Joined Aug 2011 | 3,541 Posts

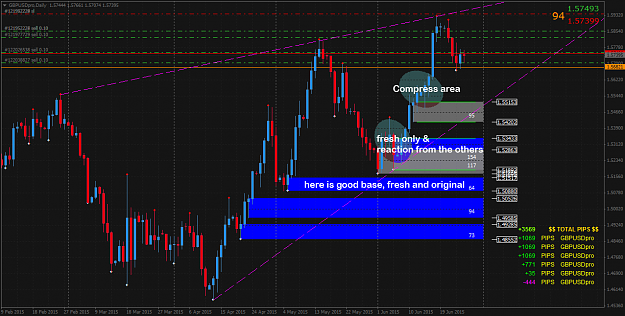

Set and Forget supply and demand trading community