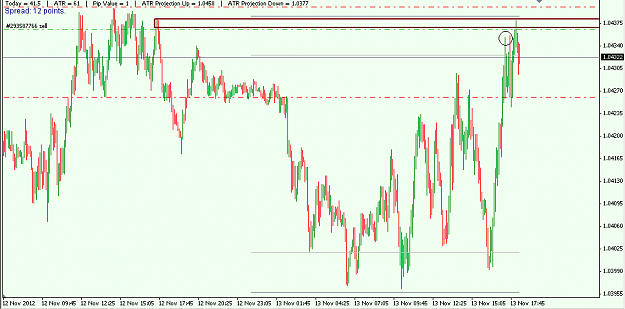

DislikedYou can combine them yes but I've just had a quick look and there were two levels on top of each other. One of them were bound to turn price.

I didn't see the rejection I like to see off the first level. It really did slice through it.Ignored

- | Membership Revoked | Joined Aug 2006 | 11,977 Posts

Nothing to it, but to do it!!! Stick to the plan FOOL!!!!

- | Membership Revoked | Joined Aug 2006 | 11,977 Posts

Nothing to it, but to do it!!! Stick to the plan FOOL!!!!

- | Membership Revoked | Joined Aug 2006 | 11,977 Posts

Nothing to it, but to do it!!! Stick to the plan FOOL!!!!