DislikedJust a quick follow-up to this. The free exn plan has definitely been working well for me the past few weeks and I think it's also worth noting that their desktop pro software is the better option to use with it.Ignored

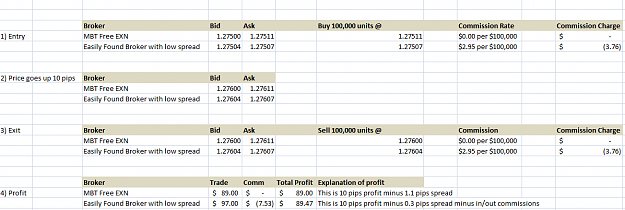

Take the EUR/USD on free exn. The spread is usually 1.1 pips on MBT Free Exn. Now you can easily find brokers who have 0.3 pips spread on EUR/USD. Effectively you are paying about 0.8 pips each way as commission with MBT or 1.6 pips round trip.

Say your usual position size is 10 lots or $100,000. Which is $10 per pip. So that means you pay MB Trading $16 commission per $100,000 traded.

Most brokers charge $2.95 per $100,000 or in other words $5.90 round trip.

That just the EUR/USD no other forex instrument has a smaller spread. With free exn and instruments like AUDUSD or GBPUSD the spread is usually 2+ pips so you end up paying an effective commission of $30 per $100,000.

We're all stories in the end. Just try to make it a good one.