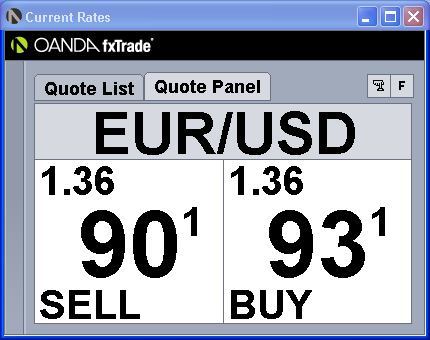

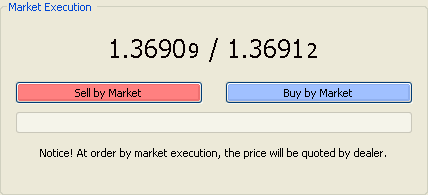

So my research into brokers took a few twists and turns. Originally I was looking at Dukascopy versus FXCM, but after some bad personal experiences, I started looking wider. My initial thoughts on Oanda were not positive, but I've had a better experience setting up there. Same with MBT, I originally heard about tech issues. I always test support for a broker before I even open a live account (not a fan of demos) and put in some small money to see how it goes. Support from both was great, they gave me great answers to my questions. MB now has an extensive YouTube catalog of webinar tutorials that show their platforms in detail. At this point, I am running a daily comparison Oanda vs. MBT FREE EXN plan. The experience has been interesting to say the least. Before I put more money into either one, does anyone have any comments about either broker. Have you experienced worse executions as you add money and your account gets bigger? Any other issues? Oanda supposedly (according to the report they file) has slight higher profitable traders, but this FREE EXN plan has amazingly tighter spreads and my executions have been solid, so I wonder how the profitability comparison goes if it were just this plan versus Oanda. Anyway, looking for any comments between the two. I'm not interested in all of these obscure, unknown brokers, I definitely wanted one of the big ten or so and someone regulated with a solid reputation.