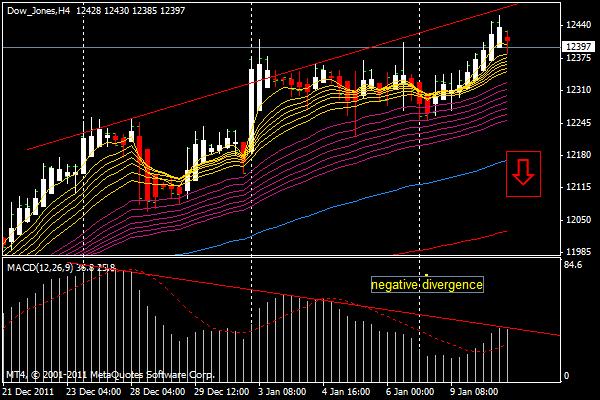

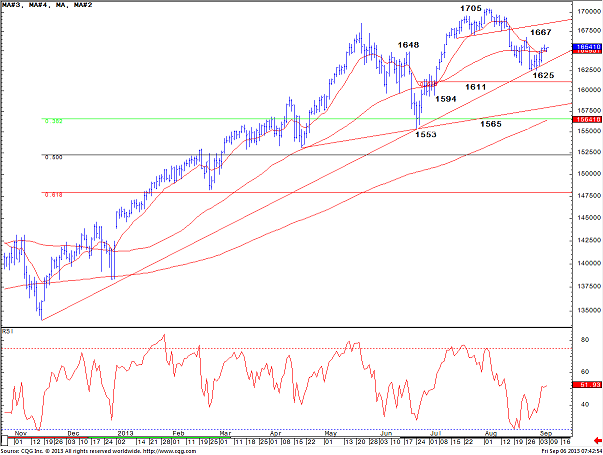

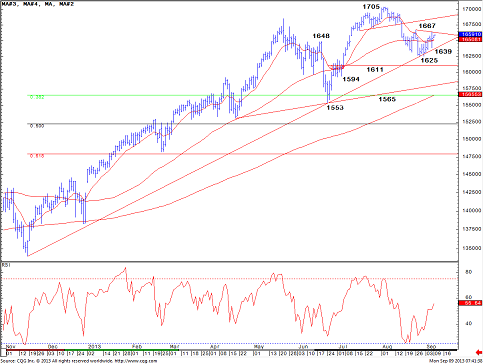

dow 4H charts indicates down trend but uptrend is near term....

- Joined Jul 2011 | Status: Member | 7,712 Posts

If you trade like me, you'll be homeless and broke within a week.

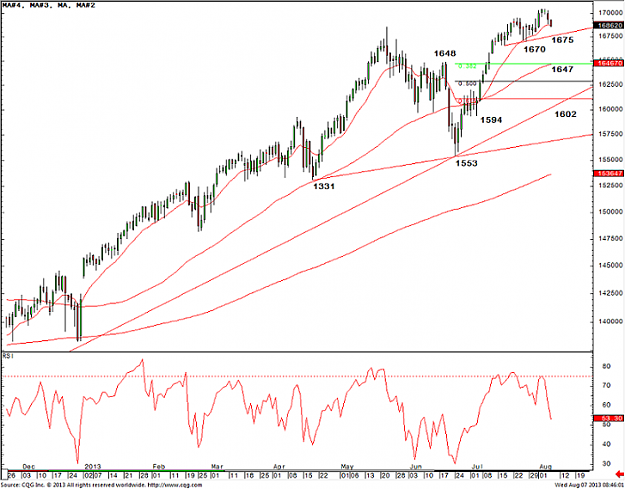

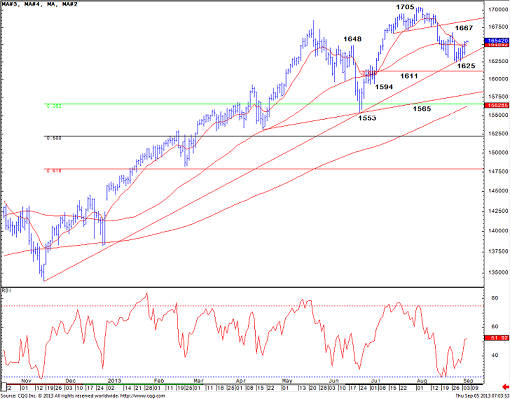

Quantum Physics Return This Week:

na