Hi There,

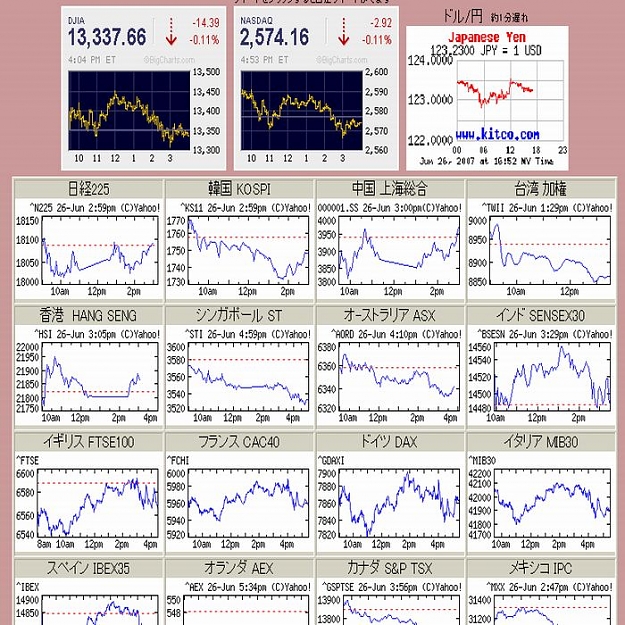

I have been watching closely how the DOW has been leading almost point for point increases/decreases in the USD.JPY pair. In relation to this the EUR.JPY pair tends to follow the USD>JPY pair during the NY hours. Once the Nikkei kicks in its that indicie that leads the 2 two pairs.

Now please bear with me, is this a normal trend path or is there more of a correlation due to the Carry trades crisis? or is this a normal correlation between the indicies and the currency pairs?

Also in addition to the above if there is a correlation between the DOW/NIKKEI on the pairs is there one that is correlated to EUR/USD as that pair tends to go in directions of its own regardless of the USD.JPY/EUR.JPY pairs.

Sorry just to add this is not my trading methodolody or strategy simply an education imput to add. knowledge is power-

keep using the charts

thanks

kevlot

I have been watching closely how the DOW has been leading almost point for point increases/decreases in the USD.JPY pair. In relation to this the EUR.JPY pair tends to follow the USD>JPY pair during the NY hours. Once the Nikkei kicks in its that indicie that leads the 2 two pairs.

Now please bear with me, is this a normal trend path or is there more of a correlation due to the Carry trades crisis? or is this a normal correlation between the indicies and the currency pairs?

Also in addition to the above if there is a correlation between the DOW/NIKKEI on the pairs is there one that is correlated to EUR/USD as that pair tends to go in directions of its own regardless of the USD.JPY/EUR.JPY pairs.

Sorry just to add this is not my trading methodolody or strategy simply an education imput to add. knowledge is power-

keep using the charts

thanks

kevlot