Exploit for balancing basket.

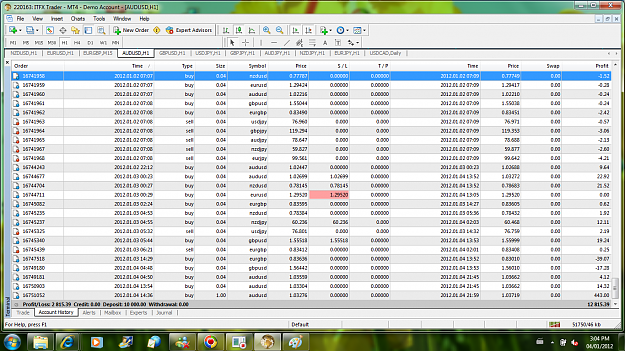

Notice on Wednesday...I invested short-term in the AUDUSD.

Tripple SWAP today at 5 pm credit...Just another method of Managing Draw DOWN.

usually buy try to get in at last min..this will run the price up and then they take profit after, run the price down..

Now it's not 100% so dont close your eyes and buy...Pitbull will tell you when, The strongest currency at the time.

Cheers

Notice on Wednesday...I invested short-term in the AUDUSD.

Tripple SWAP today at 5 pm credit...Just another method of Managing Draw DOWN.

usually buy try to get in at last min..this will run the price up and then they take profit after, run the price down..

Now it's not 100% so dont close your eyes and buy...Pitbull will tell you when, The strongest currency at the time.

Cheers