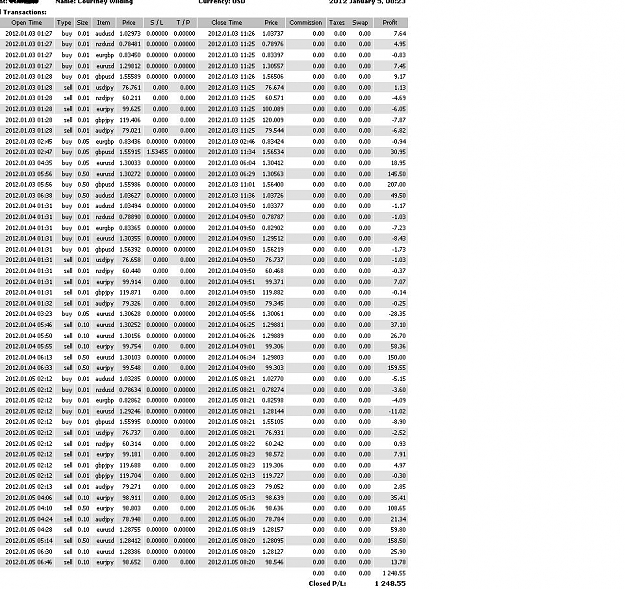

Disliked1) if the biggest profit pair was a short position (say AJ) and the biggest loser was a long position (say AU) you would enter a long position (0.04) on both, am I correct?Ignored

as the pairs move you are no longer viewing the results of a single pair, but an overview of the general market direction (you have gone from trading shares in microsoft to trading the FTSE 100) and are viewing true price action.

so we wait for the indi to settle ie 5 longs are in profit and the 5 shorts are at loss, this means that the market is generally long as all pairs are moving up.

what this thread is now showing you is how to take advantage of this info by trading to the market strength - in simple terms - make like a sheep and follow the herd - the simplest way to make money in FX.

it really doesn't get any simpler than this - personnaly i don't open the 10pairs live, this leave me more room and less headaches to manage my actuall trades.

you should each find the process that best suits you and trade it for a good period of time to truely understand it - there's plenty of time and money in forex, so please don't rush to lose all yours.