Dislikedtook two trades today.

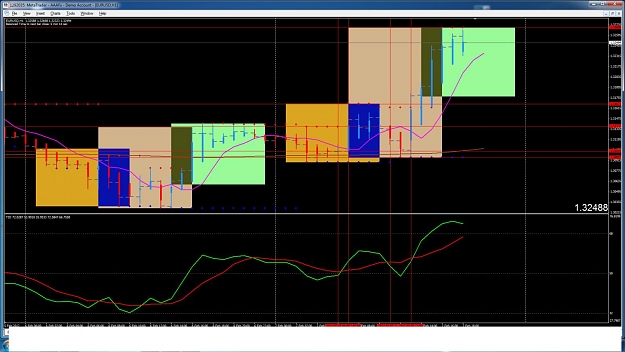

First trade occured on the open of the Blue candle after the first red arrow. I thought the move up would continue after the consolidation/rest of that huge blue candle spike. In hindshight. It was a bad entry. What am I missing. 20 pip loss.

Next trade occured on the 2nd red arrow because I saw the price bar close down and TDI cross. Got out for 20 pips. The move down seemed weak. Although I wanted to hold on longer.

SLs and TPs were set at 50 pips intitially.

Sorry X-man, I forgot to ask you as well. Would you have...Ignored

HM,

Buying into Resistance ,

and

Selling into Support

are both common mistakes traders make all the time.

You are also generous with your initial Stop Loss.

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett