Hi,

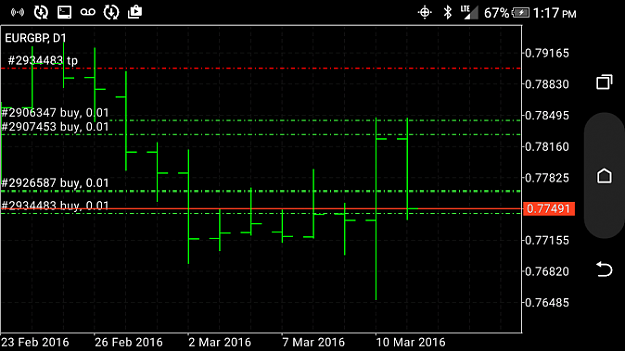

Are there any grid traders here who trade the eurgbp exclusively? I was going through the charts yesterday and collected the following statistics:

eurgbp has had an average daily range of about 39 pips, weekly average range of about 63 pips and a monthly range average of about 143 pips. These are the past 5 years averages.

Going by the numbers, isn't this the best pair to grid trade profitably and consistently. A general view from 8th September 2002 to 5th May 2003 shows a high and low of 1013 pips gained in a very painful (slow and steady) manner, and thereafter, the pair has constantly remained within that range.

Keeping the above in mind, isn't this pair, a grid traders dream come true?

Response appreciated by all, and especially by grid traders in this forum.

Thanks

Stu

P.S: Kindly do not move this to the beginner forum. I am looking at a discussion here, and not the definition of grid trading. I know what grid trading is.

Are there any grid traders here who trade the eurgbp exclusively? I was going through the charts yesterday and collected the following statistics:

eurgbp has had an average daily range of about 39 pips, weekly average range of about 63 pips and a monthly range average of about 143 pips. These are the past 5 years averages.

Going by the numbers, isn't this the best pair to grid trade profitably and consistently. A general view from 8th September 2002 to 5th May 2003 shows a high and low of 1013 pips gained in a very painful (slow and steady) manner, and thereafter, the pair has constantly remained within that range.

Keeping the above in mind, isn't this pair, a grid traders dream come true?

Response appreciated by all, and especially by grid traders in this forum.

Thanks

Stu

P.S: Kindly do not move this to the beginner forum. I am looking at a discussion here, and not the definition of grid trading. I know what grid trading is.