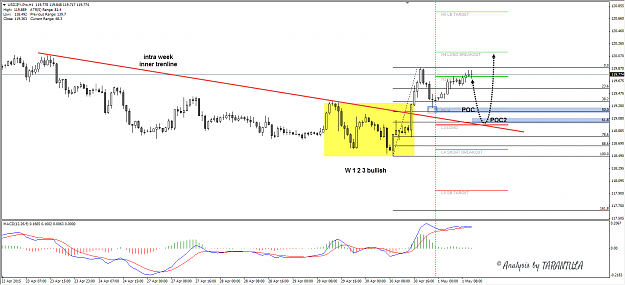

DislikedUSDJPY has been put in a heavy range waiting for FOMC. H1 chart shows no obvious movement , but watching H4 we can spot Higher Lows near the support of both intra month and intra week trend lines along with 78.6-88.6 deep retracement. 118.40 (L3) is interim support and as long as it holds USDJPY could bounce to 119.75 region ( H4, 23.6, upper trend line ). Only the break of 118.40 could tank the pair down to 117.90. So there is a possibility that USDJPY will be bought from current levels. {image}Ignored

- Post #21,361

- Quote

- Apr 30, 2015 11:10am Apr 30, 2015 11:10am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,362

- Quote

- Apr 30, 2015 12:29pm Apr 30, 2015 12:29pm

Scalping

small stop loss ; ) All Time Return:

53.3%

- Post #21,363

- Quote

- May 1, 2015 12:00am May 1, 2015 12:00am

- | Joined Jan 2015 | Status: Zaedno pravi sila. Cosmos e za nas. | 1,915 Posts

- Post #21,364

- Quote

- May 1, 2015 12:54am May 1, 2015 12:54am

- | Joined Jan 2015 | Status: Zaedno pravi sila. Cosmos e za nas. | 1,915 Posts

- Post #21,365

- Quote

- May 1, 2015 3:36am May 1, 2015 3:36am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,366

- Quote

- May 1, 2015 3:55am May 1, 2015 3:55am

- Joined Apr 2008 | Status: Member | 9,414 Posts

- Post #21,367

- Quote

- May 1, 2015 4:24am May 1, 2015 4:24am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,368

- Quote

- May 1, 2015 5:20am May 1, 2015 5:20am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,370

- Quote

- May 4, 2015 3:59am May 4, 2015 3:59am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,371

- Quote

- May 4, 2015 4:07am May 4, 2015 4:07am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,373

- Quote

- May 4, 2015 7:13am May 4, 2015 7:13am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,374

- Quote

- May 4, 2015 11:18am May 4, 2015 11:18am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,375

- Quote

- May 5, 2015 4:14am May 5, 2015 4:14am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,376

- Quote

- May 5, 2015 4:15am May 5, 2015 4:15am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,377

- Quote

- May 5, 2015 8:30am May 5, 2015 8:30am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,378

- Quote

- May 6, 2015 4:02am May 6, 2015 4:02am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,379

- Quote

- May 6, 2015 7:26am May 6, 2015 7:26am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,380

- Quote

- May 6, 2015 4:09pm May 6, 2015 4:09pm

Scalping

small stop loss ; ) All Time Return:

53.3%