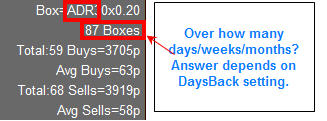

DislikedWell, my first instinct, without even looking at your settings, is to guess that your settings are too loose, and are therefore giving you too many CZ's to consider trading with. And this is causing you to over-trade. Which to me is the #1 reason you are having less than stellar results.

By comparison, I have an over-all long term (yearly) win ratio of 95% or better. Some weeks/months I have no losses at all. This is because I am selecting only the very best CZ's to trade from. Which means I am never seeing 115 boxes per week, no matter how...Ignored

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.

- | Commercial Member | Joined May 2011 | 1,754 Posts

To improve is to change. To perfect, is to change often.