Continuation of our deleted thread... I hope we all can learn something here

These are my rules:

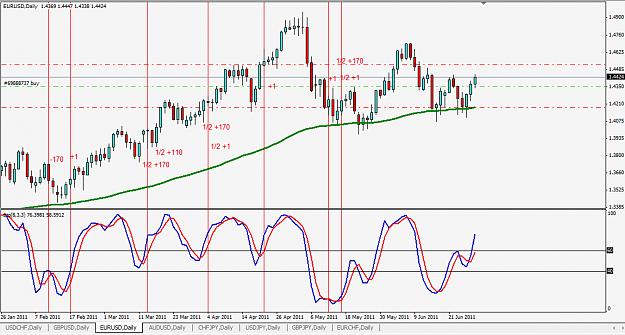

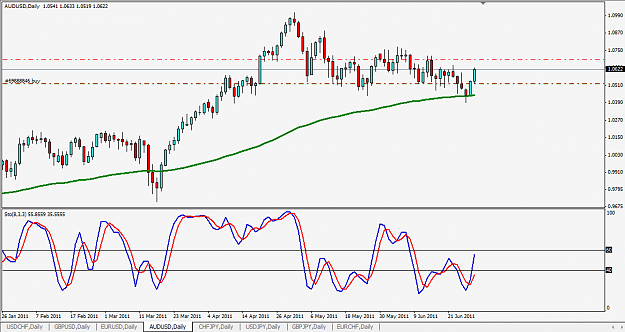

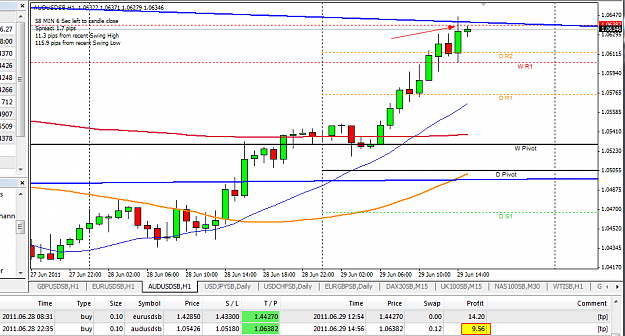

1) Simple charts - only Stochastics indicator (8,3,3), daily candles. In the Stoch window, lines at 40 and 60 levels. Moving average (exponential) 100. That is it, nothing else...

2) Buy - price ends the day candle above the MA (always wait for the candle to close). The Stoch lines cross under the level 60 (the faster Stoch line crosses the slow from underneath) - this can happen one thing after another. So it is OK if the Stoch lines cross, the price is under the MA and then finishes another day above the MA - on the next day open I go long. Or the price is above the MA and then the Stoch lines cross... I think it is easy

3) Sell - vice versa...

4) Exits - there are three exit types: a) the SL is hit (oh well, s*** happens ) b) the Stoch lines cross the opposite way than the entry is and then the fast Stoch goes under the 60 level (on longs) or above 40 level (on shorts). c) the system says to open the opposite trade (I am long and the system says go short and vice versa). I will post pictures...

) b) the Stoch lines cross the opposite way than the entry is and then the fast Stoch goes under the 60 level (on longs) or above 40 level (on shorts). c) the system says to open the opposite trade (I am long and the system says go short and vice versa). I will post pictures...

4) My money management (the key to success) - I risk 3% of my account. I open two trades, one is 1,5%, the second half as well. First half has this setting - SL=170 pips, TP=170 pips, BE+1 when the price reaches +100 pips. On GBPUSD the SL and TP is 200 pips.

Second half setting - SL=170 pips, TP=none (wait for the exit as per rules), BE+1 when the price reaches +100 pips.

5) Psychology - in my opinion the most important thing in trading! Stick to the rules!!!!!!!!!!!!!!!!!!!!!!

If you use other rules, please share

Backtesting results (around year and half back):

USDCHF +1573 pips

GBPUSD +1068 pips (but I will do further backtest coz just by looking at the charts there are better results in further history)

EURUSD +1678 pips

That is total of 4319 pips in around 18 months = 240 pips/month

That means when you risk 2% per trade a little more than 2% profit on your account every month. That is nice for watching the charts 5 min. a day (sometimes even less, because you dont have to watch the charts when your Stoch is far from crossing) The winning percentage is:

USDCHF 68%

GBPUSD 68%

EURUSD 77%

Happy trading

These are my rules:

1) Simple charts - only Stochastics indicator (8,3,3), daily candles. In the Stoch window, lines at 40 and 60 levels. Moving average (exponential) 100. That is it, nothing else...

2) Buy - price ends the day candle above the MA (always wait for the candle to close). The Stoch lines cross under the level 60 (the faster Stoch line crosses the slow from underneath) - this can happen one thing after another. So it is OK if the Stoch lines cross, the price is under the MA and then finishes another day above the MA - on the next day open I go long. Or the price is above the MA and then the Stoch lines cross... I think it is easy

3) Sell - vice versa...

4) Exits - there are three exit types: a) the SL is hit (oh well, s*** happens

4) My money management (the key to success) - I risk 3% of my account. I open two trades, one is 1,5%, the second half as well. First half has this setting - SL=170 pips, TP=170 pips, BE+1 when the price reaches +100 pips. On GBPUSD the SL and TP is 200 pips.

Second half setting - SL=170 pips, TP=none (wait for the exit as per rules), BE+1 when the price reaches +100 pips.

5) Psychology - in my opinion the most important thing in trading! Stick to the rules!!!!!!!!!!!!!!!!!!!!!!

If you use other rules, please share

Backtesting results (around year and half back):

USDCHF +1573 pips

GBPUSD +1068 pips (but I will do further backtest coz just by looking at the charts there are better results in further history)

EURUSD +1678 pips

That is total of 4319 pips in around 18 months = 240 pips/month

That means when you risk 2% per trade a little more than 2% profit on your account every month. That is nice for watching the charts 5 min. a day (sometimes even less, because you dont have to watch the charts when your Stoch is far from crossing) The winning percentage is:

USDCHF 68%

GBPUSD 68%

EURUSD 77%

Happy trading

Live it or leave it!