A lot of people have asked me how to draw a trendline during the past years, also sharing their concern about lack of proper knowledge about such an well-known phenomenon like trendlines. So I decided to share a set of rules in this how-to thread with main focus on correct identification.

Criteria & identification

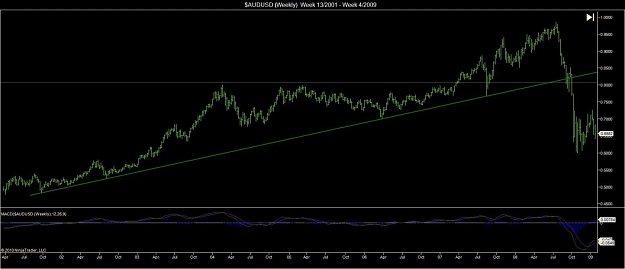

Any trendline should be drawn through/connecting at least 3 extreme points on your chart without any intersection to the other side, not even by 1 pip. This goes for all time-frames but expect a larger follow-through on higher time-frame. Note that a break of a trendline lasted for several years usually results in a trend reversal (see aud/usd chart).

Plan of action

There are two ways to take advantage out of a trendline:

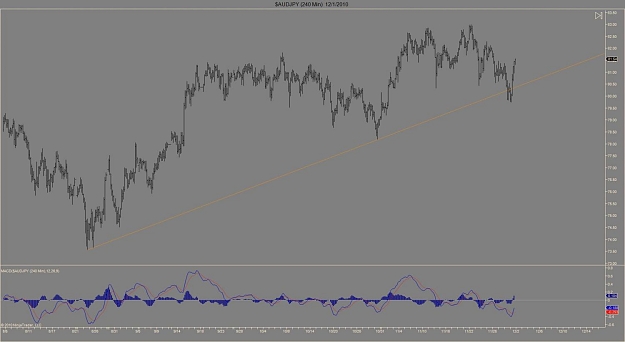

1. Either by buying/selling 5 pips ahead of the trendline acting as support/resistance. Only valid when price is heading for the forth touch towards the trendline.

2. Anticipating a break-out. The trendline has now four touches and price is heading for a fifth touch, which in most cases leads to a break-out. A break-out occurs when price has broken the trendline even by one pip.

Stop loss should always be placed outside the daily range. If price is further away than 40 pips, I skip the whole scenario because of the wide stop loss.

Note of caution

A perfect trendline setup is rather rare so don't expect it to happen once a day. You will also find that it takes some practice to get this right since conducting a trading-plan relaying only on a single angled line is rather complicated.

This is no holy grail and you should expect false break-outs to occur from time to time. This should not be problematic for a trader if proper money-management is used.

Criteria & identification

Any trendline should be drawn through/connecting at least 3 extreme points on your chart without any intersection to the other side, not even by 1 pip. This goes for all time-frames but expect a larger follow-through on higher time-frame. Note that a break of a trendline lasted for several years usually results in a trend reversal (see aud/usd chart).

Plan of action

There are two ways to take advantage out of a trendline:

1. Either by buying/selling 5 pips ahead of the trendline acting as support/resistance. Only valid when price is heading for the forth touch towards the trendline.

2. Anticipating a break-out. The trendline has now four touches and price is heading for a fifth touch, which in most cases leads to a break-out. A break-out occurs when price has broken the trendline even by one pip.

Stop loss should always be placed outside the daily range. If price is further away than 40 pips, I skip the whole scenario because of the wide stop loss.

Note of caution

A perfect trendline setup is rather rare so don't expect it to happen once a day. You will also find that it takes some practice to get this right since conducting a trading-plan relaying only on a single angled line is rather complicated.

This is no holy grail and you should expect false break-outs to occur from time to time. This should not be problematic for a trader if proper money-management is used.

Measure twice, cut once