TEB 4 MA system

This was one of the 1st system I worked on

It is vert simple but works well

It is based on the ebook- start on page 5 save some time

I did add a few changes

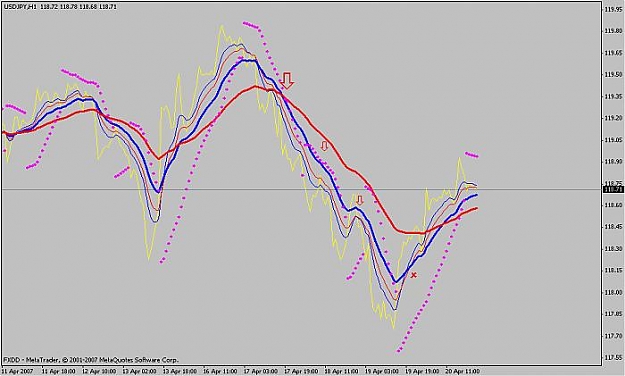

5 EMA blue thin

12 EMA red thin

20SMA blue Thick

50 EMA RED THICK

PRICE line Yellow ( 1 SMA). " the target"

I used it before I understood candle.. with it you don't have to understand candles

in fact I think the system works better with out candles

it is earier to see the crosses& bounces

"I just replaced the candles with the normal price line (1SMA)

its on your chart right beside the candle sign on the tool bar

it is a basic MA crosses

Also as an added strenght-

only take trades up when both blues are up over their red partners

only take trades down when both reds are up over their blue Partners

Enter (see chart 1)

1st kind - Initial (aggressive) entry 1st big red arrow

50 EMA trend setter only trade with him at your back

20SMA is the wall to decide the trade.. got to get over it.

the wall must have the trend setter at its back

5 EMA is the bird dog to - warn of an up coming trade..

12 EMA is the trigger man

When the 12EMA trigger man & the bird dog 5EMA go over the wall 20SMA

& with the trendsetter 50EMA at their back ....you are in

2nd kind- Pullback (conservative) entry the 2 small red arrows

Sames as the ( Initial (aggressive) entry )

But this time the 12 EMA trigger man waits in ambush

for price to come back into his line of fire

price touches or passes through the trigger man 12 EMA space & comes back through again

The trigger man always wants to be between price & the wall 20SMA

with the wall 20SMA between him & trendsetter 50EMA

when he takes the trade

Exits The red "X" ( see chart 1)

you are out when the 12EMA trigger man & 5SMA bird dog come back over the wall 20SMA

or 50 EMA trendsetter comes over the wall 20SMA after the 12EMA trigger man & 5 EMA bird dog

Bird dog rules

If the bird dog 5EMA sniffs price out

and trigger man 12EMA is not to far away from the wall 20SMA

and the price "the Target" cuts back towards the wall the 20SMA from a distances

and them tries to out run the dog 5EMA in the opp. direction from wall 20SMA

with the trend finder 50EMA where he should be

then trigger man 12 EMA should do your duty

two tricks I have found that may help

on any MA cross System esp. any "MA bounce or breaks" systems

that give you a better enter & keep you out of bad trades

ie getting chopped to death are

1. if you are trading on the 1 hour chart (chart 2nd 15 min chart)

.. when you get the set up you want

drop down to the 15 min chart

put a sars on it & let the sars be the enter sign

you will get a better price

& miss about 30% of the bad trades.

I like this one

if trading on the 4 hour drop down to the hour etc

2. if you want to keep it all on one chart (3rd chart hour chart)

put on a slow stoch at 14,3,3 low/high

and only trade with it

& again it will miss about 25% of the bad trades.

Don't do both it will only confuse the issue,

I have tried... do one or the other

hour chart

Big arrow is 1st cross & enter

little arrows are bounces & so enter

"X" is out

'15 min Chart -confirm with sacs

hour chart-- confirn with Stoch 14,3,3

Need good money Management

But it will win a lot more then it loses

Hope you make some money

& have some fun with this

TEB

This was one of the 1st system I worked on

It is vert simple but works well

It is based on the ebook- start on page 5 save some time

Attached File(s)

I did add a few changes

5 EMA blue thin

12 EMA red thin

20SMA blue Thick

50 EMA RED THICK

PRICE line Yellow ( 1 SMA). " the target"

I used it before I understood candle.. with it you don't have to understand candles

in fact I think the system works better with out candles

it is earier to see the crosses& bounces

"I just replaced the candles with the normal price line (1SMA)

its on your chart right beside the candle sign on the tool bar

it is a basic MA crosses

Also as an added strenght-

only take trades up when both blues are up over their red partners

only take trades down when both reds are up over their blue Partners

Enter (see chart 1)

1st kind - Initial (aggressive) entry 1st big red arrow

50 EMA trend setter only trade with him at your back

20SMA is the wall to decide the trade.. got to get over it.

the wall must have the trend setter at its back

5 EMA is the bird dog to - warn of an up coming trade..

12 EMA is the trigger man

When the 12EMA trigger man & the bird dog 5EMA go over the wall 20SMA

& with the trendsetter 50EMA at their back ....you are in

2nd kind- Pullback (conservative) entry the 2 small red arrows

Sames as the ( Initial (aggressive) entry )

But this time the 12 EMA trigger man waits in ambush

for price to come back into his line of fire

price touches or passes through the trigger man 12 EMA space & comes back through again

The trigger man always wants to be between price & the wall 20SMA

with the wall 20SMA between him & trendsetter 50EMA

when he takes the trade

Exits The red "X" ( see chart 1)

you are out when the 12EMA trigger man & 5SMA bird dog come back over the wall 20SMA

or 50 EMA trendsetter comes over the wall 20SMA after the 12EMA trigger man & 5 EMA bird dog

Bird dog rules

If the bird dog 5EMA sniffs price out

and trigger man 12EMA is not to far away from the wall 20SMA

and the price "the Target" cuts back towards the wall the 20SMA from a distances

and them tries to out run the dog 5EMA in the opp. direction from wall 20SMA

with the trend finder 50EMA where he should be

then trigger man 12 EMA should do your duty

two tricks I have found that may help

on any MA cross System esp. any "MA bounce or breaks" systems

that give you a better enter & keep you out of bad trades

ie getting chopped to death are

1. if you are trading on the 1 hour chart (chart 2nd 15 min chart)

.. when you get the set up you want

drop down to the 15 min chart

put a sars on it & let the sars be the enter sign

you will get a better price

& miss about 30% of the bad trades.

I like this one

if trading on the 4 hour drop down to the hour etc

2. if you want to keep it all on one chart (3rd chart hour chart)

put on a slow stoch at 14,3,3 low/high

and only trade with it

& again it will miss about 25% of the bad trades.

Don't do both it will only confuse the issue,

I have tried... do one or the other

hour chart

Big arrow is 1st cross & enter

little arrows are bounces & so enter

"X" is out

'15 min Chart -confirm with sacs

hour chart-- confirn with Stoch 14,3,3

Need good money Management

But it will win a lot more then it loses

Hope you make some money

& have some fun with this

TEB