I think its funny everyone is always speaking

of the Holy Grail. of trading "if I just get the right 10 tools"

the big boys know the tools don't really matter

You want to win?

They all say find a set up & use one tool as a trigger. ONE TOOL !!

But they also know the H.G. of trading is time frame trading

They never use more then 2 tools (any number of MAs count as 1 tool)

But they use 2- 3 or more time frames

& 1 or 2 tools on those time frames.

The tools really don't matter

see for yourself use your favour tool

or just try one of the following

a. Sars b. 5/6 Ema cross c.5/5 open/close Ema cross or any other MA set

d. Stoch what ever setting you like e. MACD

and put it on 3 time frames a. day b 4 hour c. 30 min (or hour)

and watch for all three to line up & you will win!! like 90-95%

take the day tool off & you will still win like 85-90% of the time

some tools are better then other & some are easier to work with.

But not by much

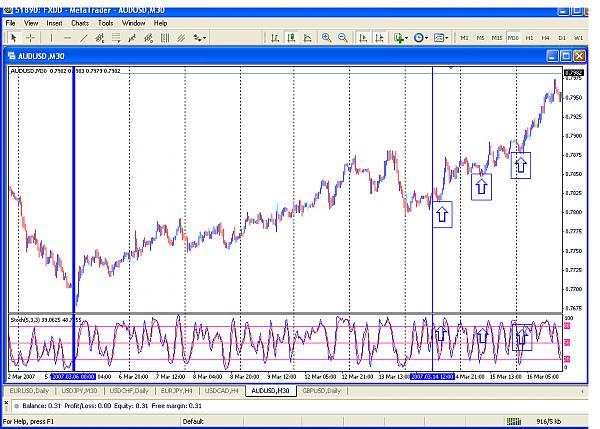

30 min chart

the Big blue line shows the trend from the day Stoch is up

the small blue line shows the trend from is 4 hour stoch is up

the Blue arrows are from the 30 min stoch below and show the trend is up

just try it for yourself -

the problem with this Idea is its hard to sell ebooks & make a lot of money!!!

of the Holy Grail. of trading "if I just get the right 10 tools"

the big boys know the tools don't really matter

You want to win?

They all say find a set up & use one tool as a trigger. ONE TOOL !!

But they also know the H.G. of trading is time frame trading

They never use more then 2 tools (any number of MAs count as 1 tool)

But they use 2- 3 or more time frames

& 1 or 2 tools on those time frames.

The tools really don't matter

see for yourself use your favour tool

or just try one of the following

a. Sars b. 5/6 Ema cross c.5/5 open/close Ema cross or any other MA set

d. Stoch what ever setting you like e. MACD

and put it on 3 time frames a. day b 4 hour c. 30 min (or hour)

and watch for all three to line up & you will win!! like 90-95%

take the day tool off & you will still win like 85-90% of the time

some tools are better then other & some are easier to work with.

But not by much

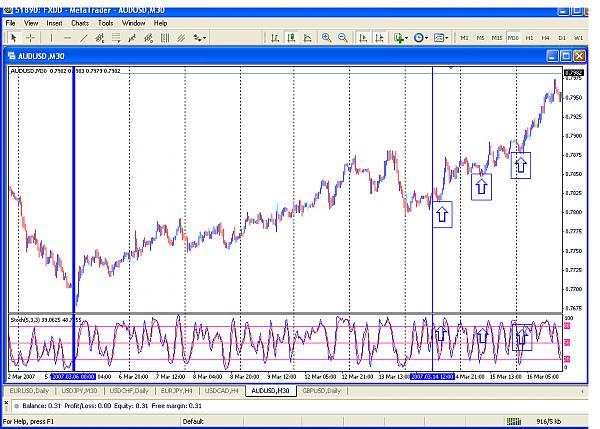

Attached Image

30 min chart

the Big blue line shows the trend from the day Stoch is up

the small blue line shows the trend from is 4 hour stoch is up

the Blue arrows are from the 30 min stoch below and show the trend is up

just try it for yourself -

the problem with this Idea is its hard to sell ebooks & make a lot of money!!!