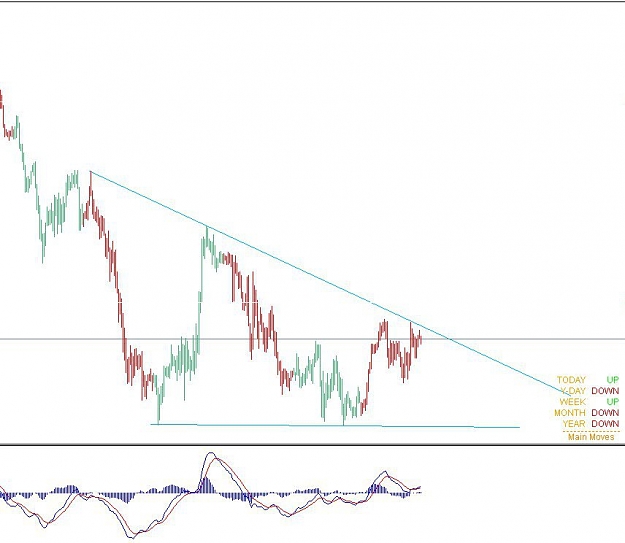

Just went short on EUR/GBP, and here's my reasoning. We seem to have one border of a possible triangle fully formed, as it has three touches. Now the bottom border does not offer that good R:R, so I'm not going to use it as a target. Another reason why I went short is that multiple(triple?) divergences on H4, with the latest one pointing to 0.87, which I'm going to use as my first target, and 0.86285 as my TP2, which is a divergence target before the first one. Not using the 0.8467 as any of my targets as it is so far away it seems unrealistic. Since I'm trading against the trend, the fact that I entered when the market is least active should help.

Entry at 0.8812, stop above the week's high at 0.88267.

No reverse planned yet. Need some time to consider.

Also, this somewhat looks like a diamond but I couldn't get a proper broadening triangle on the left hand side, so I'm trading this simply as a triangle.

Entry at 0.8812, stop above the week's high at 0.88267.

No reverse planned yet. Need some time to consider.

Also, this somewhat looks like a diamond but I couldn't get a proper broadening triangle on the left hand side, so I'm trading this simply as a triangle.