What should be the appropriate position size taken?

I trading demo account and am getting some good pips. But I think I am being too conservative because I am not getting enough $s. At the same time, I tried out accounts where I traded larger amounts, they have too large a drawdowns. Its ok on a demo account, but it will severly strain in the real account.

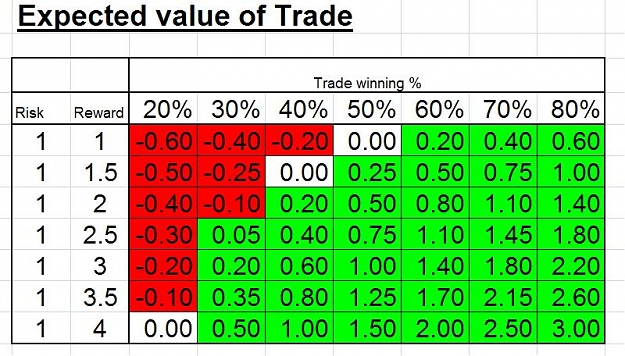

Can the pros here tell me what are you trading? How do you manage and balance these risk-reward? Are there times when you go big-lots?

Thanks very much for your answers,

I trading demo account and am getting some good pips. But I think I am being too conservative because I am not getting enough $s. At the same time, I tried out accounts where I traded larger amounts, they have too large a drawdowns. Its ok on a demo account, but it will severly strain in the real account.

Can the pros here tell me what are you trading? How do you manage and balance these risk-reward? Are there times when you go big-lots?

Thanks very much for your answers,