Hi all.. most articles on position sizing / lot sizing do NOT explain how to factor risk in YOUR LOCAL CURRENCY terms. This is crucial if you want to have a grip on your money management. I've thought it through & will attempt a step-by-step guide on position sizing / lot sizing. Experts, please correct me where I'm wrong.

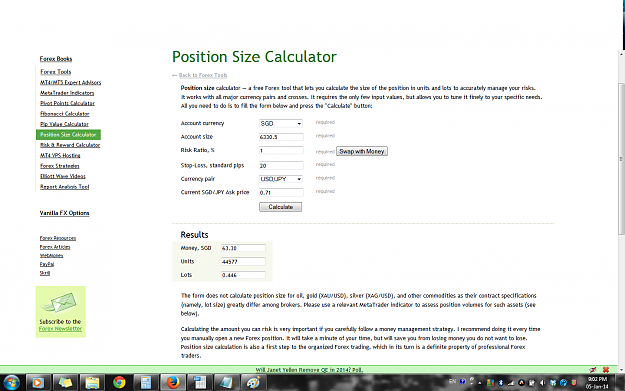

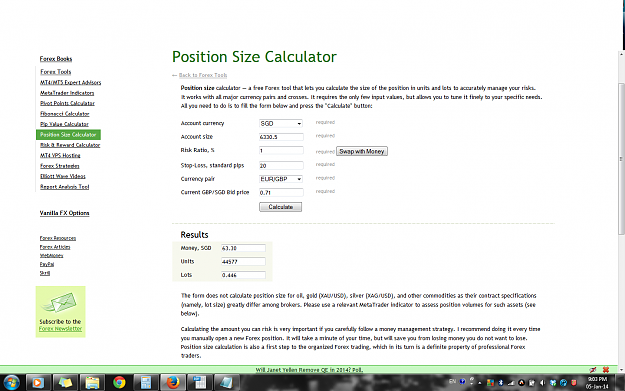

As a "newbie" to FX, all the articles I've read gave me the feeling that the explanations got from a-y BUT stop short of z. The z being how to consider risk in your LOCAL currency terms. Many articles advocate using a max of 2% of your capital so that you can last longer in your trading journey. This is a good thing. But what is not clear is how to size it in your LOCAL currency terms. Some articles will then provide links to position size calculators. But hey, isn't it important to know exactly how to calculate risk since it is MY $ @ risk.. or would you prefer to skip the thinking & depend on some online black-box calculator??

1) Account size (in your LOCAL currency) = S$10,000 (S$)... the local currency in this eg. is SGD

2) Risk per trade = 2% of capital

in your LOCAL currency terms = 0.02 x S$10,000 = S$200 per trade

3) Convert risk per trade from your LOCAL currency terms to the currency you are TRADING

eg. if trading EUR/USD, convert to the currency in the direct quote, the USD.

EUR/USD = 1.2500 => means EUR1 = USD1.25

the currency NOT quoted in the base of $1 is the currency you want to convert to.. in this example.. USD

S$1.2346 = USD1

Risk per trade in USD terms = S$200 / 1.2346 = US$162

4) Determine the number of pips to your stop loss from your entry price

eg. buy EUR/USD @ 1.2500

stop loss @ 1.2475

pips to SL = 1.2500 - 1.2475 = 0.0025 OR 25 pips

5) USD risk per pip = USD162 / 25 pips to SL = USD6.48

6) Figure out the smallest tick value for the currency you are trading.

eg. EUR/USD is quoted to 4 decimal places.. therefore the smallest tick value (aka 1 pip) is 0.0001

eg. USD/JPY is quoted to 2 decimal places.. therefore the smallest tick value (aka 1 pip) is 0.01

for EUR/USD, if it moves 1 pip, for a...

STANDARD lot, your account will move by = 0.0001 x 100,000 = USD10

....................................................MINI lot = 0.0001 x 10,000 = USD1

.................................................MICRO lot = 0.0001 x 1,000 = USD0.10

....................................................NANO lot = 0.0001 x 100 = USD0.01

7) Since I want to risk USD6.48 per pip, aka for each pip movement against me, I will lose USD6.48

If I buy 1 standard lot & EUR/USD moves 1 pip against me, I will lose USD10.

If I buy 0.648 STANDARD lots, for 1 pip against me, I will lose USD6.48

OR I can buy 6.48 MINI lots, for 1 pip against me, I will lose USD6.48

OR I can buy 64.8 MICRO lots, for 1 pip against me, I will lose USD6.48

OR I can buy 648 NANO lots, for 1 pip against me, I will lose USD6.48

Whether to trade STANDARD, MINI, MICRO or NANO depends on your account type.

Is it a pure MICRO lots ONLY account? If yes, trade 64.8 MICRO lots.

Is it a flexible account (can trade STANDARD, MINI, MICRO or NANO).. then you can trade either one. Just be sure to key in the correct units.

Cheers,

eb

Edited: correct spelling typos

As a "newbie" to FX, all the articles I've read gave me the feeling that the explanations got from a-y BUT stop short of z. The z being how to consider risk in your LOCAL currency terms. Many articles advocate using a max of 2% of your capital so that you can last longer in your trading journey. This is a good thing. But what is not clear is how to size it in your LOCAL currency terms. Some articles will then provide links to position size calculators. But hey, isn't it important to know exactly how to calculate risk since it is MY $ @ risk.. or would you prefer to skip the thinking & depend on some online black-box calculator??

1) Account size (in your LOCAL currency) = S$10,000 (S$)... the local currency in this eg. is SGD

2) Risk per trade = 2% of capital

in your LOCAL currency terms = 0.02 x S$10,000 = S$200 per trade

3) Convert risk per trade from your LOCAL currency terms to the currency you are TRADING

eg. if trading EUR/USD, convert to the currency in the direct quote, the USD.

EUR/USD = 1.2500 => means EUR1 = USD1.25

the currency NOT quoted in the base of $1 is the currency you want to convert to.. in this example.. USD

S$1.2346 = USD1

Risk per trade in USD terms = S$200 / 1.2346 = US$162

4) Determine the number of pips to your stop loss from your entry price

eg. buy EUR/USD @ 1.2500

stop loss @ 1.2475

pips to SL = 1.2500 - 1.2475 = 0.0025 OR 25 pips

5) USD risk per pip = USD162 / 25 pips to SL = USD6.48

6) Figure out the smallest tick value for the currency you are trading.

eg. EUR/USD is quoted to 4 decimal places.. therefore the smallest tick value (aka 1 pip) is 0.0001

eg. USD/JPY is quoted to 2 decimal places.. therefore the smallest tick value (aka 1 pip) is 0.01

for EUR/USD, if it moves 1 pip, for a...

STANDARD lot, your account will move by = 0.0001 x 100,000 = USD10

....................................................MINI lot = 0.0001 x 10,000 = USD1

.................................................MICRO lot = 0.0001 x 1,000 = USD0.10

....................................................NANO lot = 0.0001 x 100 = USD0.01

7) Since I want to risk USD6.48 per pip, aka for each pip movement against me, I will lose USD6.48

If I buy 1 standard lot & EUR/USD moves 1 pip against me, I will lose USD10.

If I buy 0.648 STANDARD lots, for 1 pip against me, I will lose USD6.48

OR I can buy 6.48 MINI lots, for 1 pip against me, I will lose USD6.48

OR I can buy 64.8 MICRO lots, for 1 pip against me, I will lose USD6.48

OR I can buy 648 NANO lots, for 1 pip against me, I will lose USD6.48

Whether to trade STANDARD, MINI, MICRO or NANO depends on your account type.

Is it a pure MICRO lots ONLY account? If yes, trade 64.8 MICRO lots.

Is it a flexible account (can trade STANDARD, MINI, MICRO or NANO).. then you can trade either one. Just be sure to key in the correct units.

Cheers,

eb

Edited: correct spelling typos