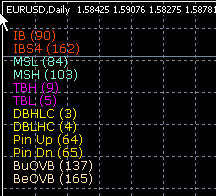

EU at major Res zone now. lots of bullish pins on 4hr, that didnt break at all really.

its only going north though unless we see a close below 1.58

Hopefully another daily pin or 4hr to allow a bullish entry again...

its only going north though unless we see a close below 1.58

Hopefully another daily pin or 4hr to allow a bullish entry again...