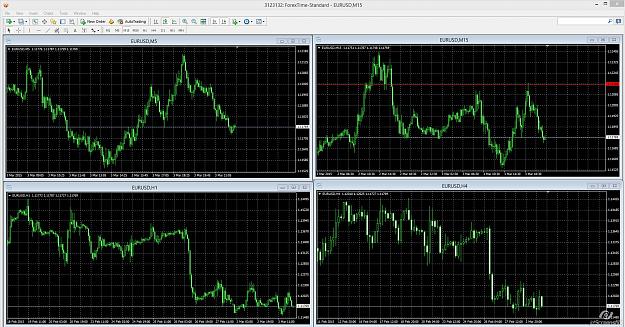

Just to be clear, I didn't post the H1 chart with the intention of saying that it was signalling a downwards move. My only intention was to show that even Red's setups are time frame dependent, as there is no way he could see some of his intraday scalps on a H1 chart etc. However, when it comes to the way price moves, that is when I would agree that time frame has no place. A H4 chart will show the same kinds of patterns as an M5 chart. The only difference is that at times of very low liquidity, you might see the M5 chart look a little more spiky. Other than that, it's all the same.

In boxing, all the champion's results are visible. In forex, talk is cheap.