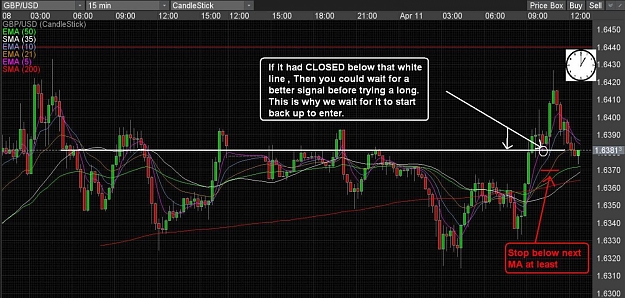

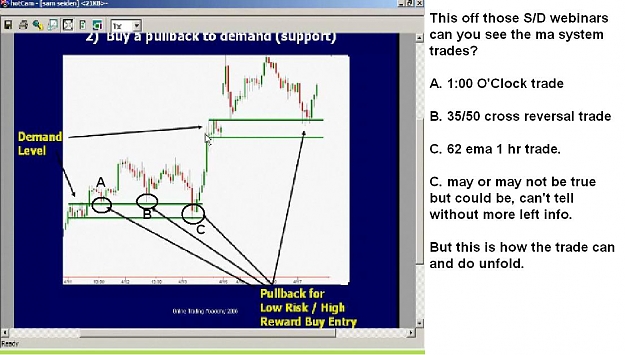

So you may actually take the trade where the MA"s were. The best and most successful entries are of course where confluence exist. This means if you have seen where price has made a breakout and now a retest of a LINE it can be a S/R PPA line a session high or low the Asian is a common one that is used at Frankfurt and London open. In a strong trend it can just be a quick retrace caused by some profit taking .

The most important thing about these trades is the fact that we can use a tight stop which equates into low risk trades which is our favorite type also it can get us into a new trend as price crosses over itself.

Crap forgot your question

Yes it doesn't require a lot of thought to takes these trades what it takes is a bit of courage at most times your entering the opposite direction of a candles direction. Which is what most find hard to do. Kinda liking falling backwards trusting someone is back there to keep you from hitting the floor.

Bust as you progress you find that taking trades AWAY from the MA's is normally the proper move in any case. Long above and Short below. Even if they are the wrong trades they tend to be forgiving giving us time to exit with little or no damage.

Cheers Ken

In the 1 o'clock trade below the entry would be when the circled price touches that 5 ema and then starts pulling back. so the candle would be solid RED ,

Good Trading To All ; Ken Lee