Nitro Scalping is a trading strategy using RENKO bars instead of candles (although some still use candles).

We try to stay focused on PA (price action) instead of relying on indicators, which nearly always lag price. Our goal is to trade pure PA capturing 3-10 pips per trade.

Using this "less is more" strategy, many are saying they are making consistent profits in forex for the first time ever.

====================================================

TRADING NITRO

A commercial version of the renko bars is recommended, the free version written for MT4 does not work well.

UPDATE: some programmers in FF have been working on the free version and now say that it is working. You can visit the Renko Block Chart thread in the Programming Forum to obtain the latest version.

To locate the commercial version, do a search for "mql renko bars".

Renko bars, invented by the Japanese (of course!) operate 'outside of time'. They only form when a specific number of pip movement has been achieved no matter how long this takes. This makes the charts 'less noisy' and easier to see price movement. They take some getting used to, but most who use them for a week or two greatly prefer them to candles. (also iinvented by the Japanese....)

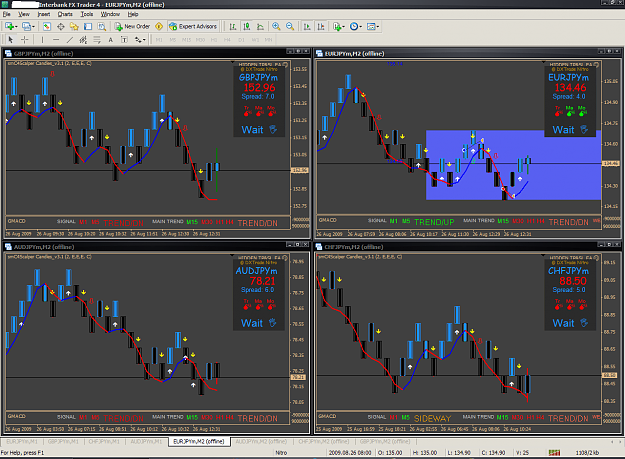

We put up 4 charts of these pairs: EY, GY, AY and either NZD/Y or CAD/Y and then during specific trading times (below) we sit back and watch for CORRELATION in price movement between the 4 pair.

USD/JPY can also be watched, but is normally not traded.

We are looking for all 4 pairs to be moving in sync. When this correlation is spotted (and it occurs at least once during every trading session) you can take your trade in all pairs or just focus on one or two. Your choice.

For indicators, we use the sm trix-colored candles (smC4scalperCandles) to color the renko bars, settings 2,1,1,1, indicator attached below.

DX Trade wrote a neat 'dashboard' and some use that, also attached

A HMA color line is used as moving average, settings are 8,3,3 or 10,3,3. Some use other settings or you can use the MA in Color with Applied Price.

Momentum indicator set to 4 is a standard MT4 indicators.

A Trix indicator is also used but it is built into the dashboard & into the candles.

And .. Chris_B wrote a Nitro arrow indicator based on momentum that many find useful (and he is still working on improving...)

All attached.

However as stated above, our goal is to ELIMINATE indicators and learn to trade on pure & naked PA (price action). Those who have learned to do this, since early August 2009, are already seeing consistent profit with a 90% or better win ratio.

As to how to do it, you will learn fastest from the charts posted on this thread.

Once CORRELATION is noted, we are looking for a 'primer' which could be trix-colored candles changing color, then a 'trigger' which could be the moving average cross.

The rules are not set in stone as people find their own favorite primers and triggers.

The object, once again, is to learn how to 'see' from PA alone where price is going next and then to capture only a fraction of that move.

Studying the charts posted in this thread is the best way to learn how to do this successfully.

Template is not provided as nearly everyone does it a bit differently. Study the charts!!

Best Hours to Trade: just before & during major market opens, i.e. Tokyo-London open or London-US Open. Renko bars can be traded anytime but best PA is during those overlap times.

The R:R is not good with this strategy .. that is admitted up front. But the WIN ratio (once you get used to doing this) is spectacular. We are going for 3-10 pip gains, usually 3-5, and do it several times until 2% account growth goal is reached. Rinse & repeat.

Stop losses are usually set at 20-30 pips (I told you the RR sucked!) But if you are winning 95% of the time .. do you care?

Some traders just wait for correlation, then pick the strongest pair and put a 5 lot trade on that one. 5 pips profit x 5 lots = 25 pips. They are done for the day.

This is not a strategy to become a mega-millionaire, just to make a comfortable full time living trading Forex. 25 pips a day trading full lots is $250 per day, 50 pips (two 5 lot trades in the example above) is $500 per day. Most can survive on that.

Please use Demo accounts only to start! When you can bank your 3-5 pips consistently without emotion you may be ready for live trading.

The method is 25% mechanical .. 75% emotion. You will learn the mechanical part with constant practice. The 75% emotional part means keeping greed in check. The temptation to try for 'just a few more pips' can be an account-killer.

NOTE: several traders who have already become skilled at doing this are now finding ways to capture more pips with longer moves. The basic strategy remains the same however, the goal is consistent daily pips, 20 to 30 total and newbies to the method are advised to become very proficient at capturing the smaller pip moves before even considering greater profits.

A $1000.00 account, gaining 25 pips per day, 5 days a week, with the power of compounding willl grow to $40k in just one year!

Many posters on this thread are already skilled at this and new ones will learn best from studying their posts & charts.

Many people are saying they are earning money consistently for the first time ever with this strategy.

***SEE ALSO POST #31, PAGE 3 FOR MORE EXPLANATION ON TRADING NITRO***

And please re-read the above one more time and help us keep the focus in this thread. If you have a favorite indicator or a neat way of using trailing stops .. please post it somewhere else .. thanks!

We try to stay focused on PA (price action) instead of relying on indicators, which nearly always lag price. Our goal is to trade pure PA capturing 3-10 pips per trade.

Using this "less is more" strategy, many are saying they are making consistent profits in forex for the first time ever.

====================================================

TRADING NITRO

A commercial version of the renko bars is recommended, the free version written for MT4 does not work well.

UPDATE: some programmers in FF have been working on the free version and now say that it is working. You can visit the Renko Block Chart thread in the Programming Forum to obtain the latest version.

To locate the commercial version, do a search for "mql renko bars".

Renko bars, invented by the Japanese (of course!) operate 'outside of time'. They only form when a specific number of pip movement has been achieved no matter how long this takes. This makes the charts 'less noisy' and easier to see price movement. They take some getting used to, but most who use them for a week or two greatly prefer them to candles. (also iinvented by the Japanese....)

We put up 4 charts of these pairs: EY, GY, AY and either NZD/Y or CAD/Y and then during specific trading times (below) we sit back and watch for CORRELATION in price movement between the 4 pair.

USD/JPY can also be watched, but is normally not traded.

We are looking for all 4 pairs to be moving in sync. When this correlation is spotted (and it occurs at least once during every trading session) you can take your trade in all pairs or just focus on one or two. Your choice.

For indicators, we use the sm trix-colored candles (smC4scalperCandles) to color the renko bars, settings 2,1,1,1, indicator attached below.

DX Trade wrote a neat 'dashboard' and some use that, also attached

A HMA color line is used as moving average, settings are 8,3,3 or 10,3,3. Some use other settings or you can use the MA in Color with Applied Price.

Momentum indicator set to 4 is a standard MT4 indicators.

A Trix indicator is also used but it is built into the dashboard & into the candles.

And .. Chris_B wrote a Nitro arrow indicator based on momentum that many find useful (and he is still working on improving...)

All attached.

However as stated above, our goal is to ELIMINATE indicators and learn to trade on pure & naked PA (price action). Those who have learned to do this, since early August 2009, are already seeing consistent profit with a 90% or better win ratio.

As to how to do it, you will learn fastest from the charts posted on this thread.

Once CORRELATION is noted, we are looking for a 'primer' which could be trix-colored candles changing color, then a 'trigger' which could be the moving average cross.

The rules are not set in stone as people find their own favorite primers and triggers.

The object, once again, is to learn how to 'see' from PA alone where price is going next and then to capture only a fraction of that move.

Studying the charts posted in this thread is the best way to learn how to do this successfully.

Template is not provided as nearly everyone does it a bit differently. Study the charts!!

Best Hours to Trade: just before & during major market opens, i.e. Tokyo-London open or London-US Open. Renko bars can be traded anytime but best PA is during those overlap times.

The R:R is not good with this strategy .. that is admitted up front. But the WIN ratio (once you get used to doing this) is spectacular. We are going for 3-10 pip gains, usually 3-5, and do it several times until 2% account growth goal is reached. Rinse & repeat.

Stop losses are usually set at 20-30 pips (I told you the RR sucked!) But if you are winning 95% of the time .. do you care?

Some traders just wait for correlation, then pick the strongest pair and put a 5 lot trade on that one. 5 pips profit x 5 lots = 25 pips. They are done for the day.

This is not a strategy to become a mega-millionaire, just to make a comfortable full time living trading Forex. 25 pips a day trading full lots is $250 per day, 50 pips (two 5 lot trades in the example above) is $500 per day. Most can survive on that.

Please use Demo accounts only to start! When you can bank your 3-5 pips consistently without emotion you may be ready for live trading.

The method is 25% mechanical .. 75% emotion. You will learn the mechanical part with constant practice. The 75% emotional part means keeping greed in check. The temptation to try for 'just a few more pips' can be an account-killer.

NOTE: several traders who have already become skilled at doing this are now finding ways to capture more pips with longer moves. The basic strategy remains the same however, the goal is consistent daily pips, 20 to 30 total and newbies to the method are advised to become very proficient at capturing the smaller pip moves before even considering greater profits.

A $1000.00 account, gaining 25 pips per day, 5 days a week, with the power of compounding willl grow to $40k in just one year!

Many posters on this thread are already skilled at this and new ones will learn best from studying their posts & charts.

Many people are saying they are earning money consistently for the first time ever with this strategy.

***SEE ALSO POST #31, PAGE 3 FOR MORE EXPLANATION ON TRADING NITRO***

And please re-read the above one more time and help us keep the focus in this thread. If you have a favorite indicator or a neat way of using trailing stops .. please post it somewhere else .. thanks!

Attached File(s)

*******************

I'd rather make money than be right.