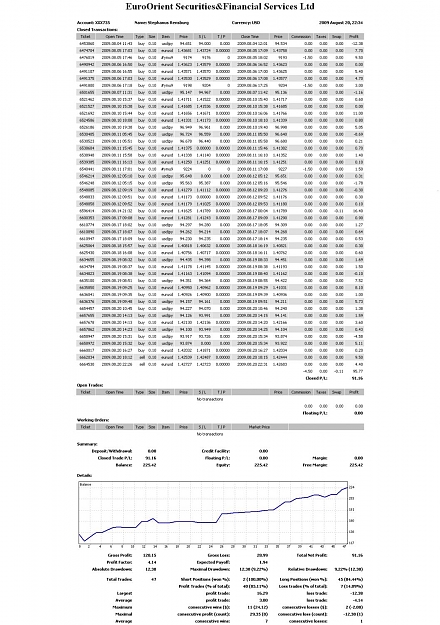

I will be posting real-time trades here from time to time and at http://www.stocktwits.com/u/stephanusR where many trades were given on Euro(fiber) and SP500. http://www.twitter.com/StephanusR will be used to indicate a pending trade before posting a real-time trade to stocktwits and forexfactory.

The market follows the 60-30-10% rule: 60% in a trending range which we have see the last two weeks on the Dow, in such a trend the RSI could remain high for extended periods and should not be shorted. Friday(15Aug) I went long the Dow indirectly by going long the Fiber (eurusd is called fiber, gbpusd is called cable), even though the Dow is overbought(RSI high value), it doesn't mean we will have some sort of catastrophic sell-off. The fundamentals of an economic recovery don't suggest this. 30% of the time the market is range bound, going short/long based on RSI combined with other factors is a good way to trade in a counter trend. 10% you have a break-out where you should trade in the direction of the break-out.

The market follows the 60-30-10% rule: 60% in a trending range which we have see the last two weeks on the Dow, in such a trend the RSI could remain high for extended periods and should not be shorted. Friday(15Aug) I went long the Dow indirectly by going long the Fiber (eurusd is called fiber, gbpusd is called cable), even though the Dow is overbought(RSI high value), it doesn't mean we will have some sort of catastrophic sell-off. The fundamentals of an economic recovery don't suggest this. 30% of the time the market is range bound, going short/long based on RSI combined with other factors is a good way to trade in a counter trend. 10% you have a break-out where you should trade in the direction of the break-out.