<hr align="center" color="#d1d1e1" noshade="noshade" size="1" width="100%">

The efficient market hypothesis (EMH) has been a highly controversial topic among financial academics for decades, and CNBC's Jim Cramer is adding fuel to the fire. Volumes of journal articles, studies and other types of scholarly works have been churned out by supporters and critics of this hypothesis and the topic continues to be debated. Read on to find out how Cramer's in-your-face stock recommendations on CNBC's "Mad Money" provide evidence that the market behaves inefficiently.<!--printable = OFF-->Implications of EMH<o

The efficient market hypothesis contends that all equities are priced in a manner that reflects all relevant information about the stocks and/or the market. One implication of EMH suggests that because market prices should instantly reflect information as it occurs, performing research through fundamental analysis should not yield any new information that can allow an investor to make market-beating investment decisions. (For more insight, read Working Through The Efficient Market Hypothesis and What Is Market Efficiency?) <o

According to EMH, market efficiency also causes prices to be unpredictable and, therefore, technical analysis should not be able to yield indicators and chart patterns that serve predictive purposes.

Keep in mind that these implications are based only on EMH theory; there is much debate about the extent to which markets are efficient - or whether they are efficient at all. For example, counter to EMH, there are examples of investment strategies where fundamental analysis has proven to be successful. In fact, the "Oracle of Omaha", Warren Buffett, has earned consistantly market-beating returns for several decades by using fundamental analysis to pinpoint underpriced companies. (For more on this, see Warren Buffett: How He Does It, What Is Warren Buffett's Investing Style? and Introduction To Fundamental Analysis.)

The Study

Researchers from <st1

For those who aren't familiar with "Mad Money", the show's host, Jim Cramer is a former hedge fund manager. On "Mad Money", Jim Cramer gives his buy/sell recommendation on a number of featured stocks, including stocks suggested by viewers' phone calls or emails. The show has become very popular - its entertaining nature about financial matters attracted more than 300,000 viewers nightly in 2006.

In this study, researchers had gathered stock returns, daily volume data, intraday quotes and other kinds of financial information on buy recommendations that Cramer made between July 28 and October 14, 2005. One of their key findings provides proof of the existence of the "Cramer bounce". According to the study, Cramer's buy recommendation causes a statistically significant short-term rise in the stock's price on the day directly following the day it is recommended. This rise is most apparent for small stocks, where the increase is just over 5% compared to the previous close. For the entire sample, the average rise is almost 2%.

Does this study suggest that Cramer has a knack for finding undervalued stocks at the right time? No. Instead, the researchers in this study theorize that stocks become overpriced because a large number of "Mad Money" viewers blindly buy stocks based on Cramer's recommendation. In other words, these rises were not attributed to any new news that companies had released and, most importantly, they were not sustained for very long. In fact, the study demonstrated that these increases faded away within 12 days. The inflation in stock prices that occurs as a result of Cramer's recommendations allows clever investors to obtain higher returns and, therefore, serves as evidence against the efficiency of the market.

The study also found that trading volume on the stocks that Cramer recommended also spiked dramatically. For smaller stocks, the trading volume increased by as much as 900% on the day following the recommendation. The most interesting effect is that, in some cases, the level of turnover stayed significantly elevated for as long as 16 days after the recommendation was made. It also appears that Cramer's recommended stocks generally receive much higher buyer-initiated trades on the day following a recommendation to buy. This may reflect a flood of purchase orders from regular "Mad Money" viewers. This peak in the proportion of buyer-initiated trades ultimately drops back to pre-recommendation levels after about 12 days. This suggests that Cramer's recommendations have a direct effect on stocks' prices.

Other Effects

The Northwestern researchers also looked at two other aspects of Cramer's recommendations: their effects on the bid-ask spread and the amount of short selling in the market.

According to the study, short sales tended to spike dramatically within the opening minutes of the trading day following Cramer's recommendation. Because successful short sellers borrow stocks to sell when prices are high and then buy them back to cover their positions when the prices are low, it could be inferred that at least some investors are aware of the Cramer bounce and are attempting to profit from what they see as an overvalued stock. (For related reading, check out the Short Selling Tutorial.)

It was also determined that the bid-ask spread for recommended stocks did not change at any point in time. This is significant because a lack of change in the bid ask spread suggests that market makers do not fear the prospect of information asymmetry as a result of Cramer's recommendations. This is because nothing new about the stock has surfaced during that time and, therefore, the current bid-ask spread should still reflect the stocks' fundamentals following Cramer's recommendation, even if the market value of the stock does not.

Why Is This Important?

One of the biggest assumptions (and potentially the biggest flaw) of the EMH is that investors are rational. This study provides evidence that the irrational behaviors of individual participants in the financial world can create predictable, collective actions that can have at least a short-term influence on stock prices. For the most part, it can be assumed that the investors that are contributing to the Cramer bounce phenomenon are making stock purchases as a result of Jim Cramer's influence, rather than as a product of rational thought.

As a general rule, emotional investors that buy stocks without doing their homework tend to miss out on good returns. In this situation, Cramer's recommendations are expensive in the days after being featured on "Mad Money" and, all things being equal, will tend to lose value as their prices settle back to pre-Cramer bounce levels.

Social Learning Theory

In psychology, the observational, or social learning theory details certain conditions that need to be met before an observer's behavior changes as a result of observing a model's behavior. One of the key points of this theory is that an observer is more likely to pay attention and follow another person's behavior if that person possesses qualities that the observer finds to be desirable. Jim Cramer's recommendations can easily sway the more emotional investors into performing trades without conducting a good amount of research, because many may feel that he is an authority on stocks and that his word should be good enough.

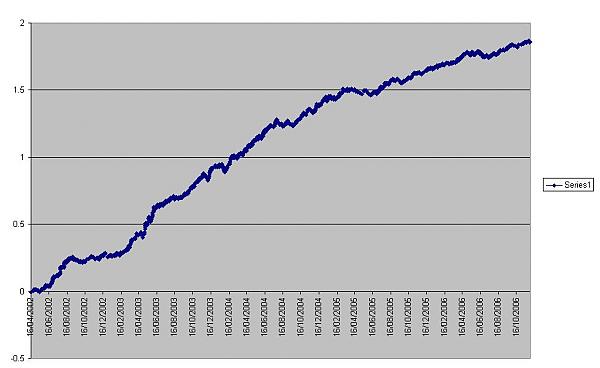

This study also found a way for certain traders to almost consistently create a steady stream of returns. More specifically, this refers to how short sellers can regularly take advantage of the Cramer bounce and short sell stocks on the day following the recommendations and then buy them back a couple of days later to earn an almost arbitrage-like profit. According to the EMH, consistently predicting and capitalizing on the market's movements should be impossible because the market moves in an unpredictable fashion.

On the flip side, we should note that the stocks' prices did eventually return to their "true" values. Therefore, while the behavior of stocks featured on "Mad Money" isn't consistent with EMH, this study also shows that stocks are (eventually) driven by fundamentals. While in this case the stocks returned to their original values in a short time span, bubbles of this sort can also continue for years, as was the case with the dotcom bubble of the late '90s. (For more insight, see The Greatest Market Crashes.)

Don't Go Mad Yourself

EMH relies on the assumption that the main players in the market are rational. This study is an example of how irrational behavior can cause stock prices to fluctuate in a manner that is contrary to EMH theory. Investors should not discount the role that emotion and investor psychology play in the way the market behaves. While there is no formula or indicator that can account for or assess the emotional aspects of investing, investors can save themselves from being caught up in "madness" by investing prudently, rather than just following the crowd.

By Albert Phung<o