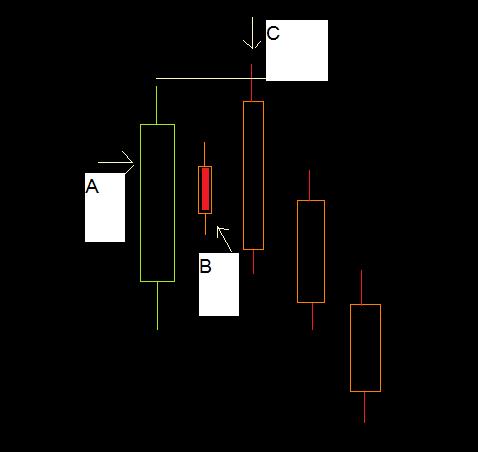

Hello here is a really simple trading method with inside bars.

1- Ist candle is larger than 60-70 pips this could be different for various pairs.

2- 2nd candle forms an Inside Bar.

3-Now when price touch the upper bar line go short and when price touch the

lower bar go long.

1- Ist candle is larger than 60-70 pips this could be different for various pairs.

2- 2nd candle forms an Inside Bar.

3-Now when price touch the upper bar line go short and when price touch the

lower bar go long.