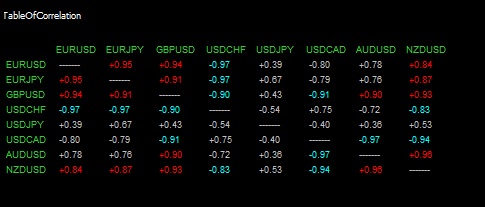

Regarding the normalization of positions and not a lot of movement... this really comes into play and is infinitely more important when you're arbing pairs with significantly different ranges and tick values. For example (completely hypothetical) if you were to arb the EURGBP and the EURSEK.

DislikedHi Profxtrader,

I can answer this from my point of view. I have done tests with different lot sizes. I could see no real benefit. One issue I had is that the better the hedge the less movement, which made 2 other problems. 1- I had to use larger lot sizes and 2- It become less profitable because the trades stayed open longer.

I like your ea. Can you give it too me please?

just kidding..

I am working on a similar automated project. I am quite happy with the results I am getting. I have come up with some novel ways to make it both safer...Ignored

Every time you use 'hopium' in a post, God kills a kitten.