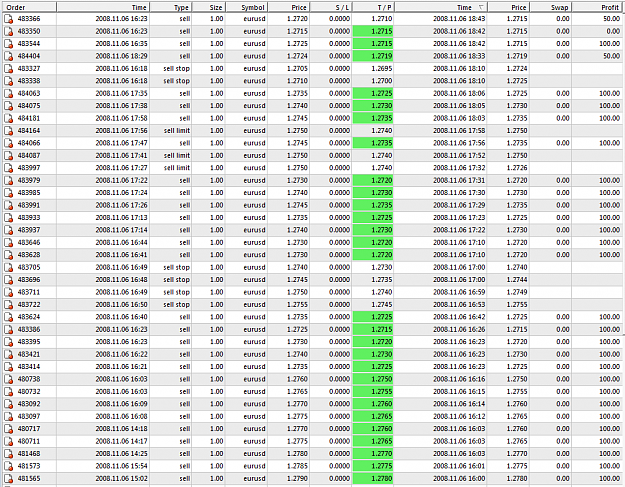

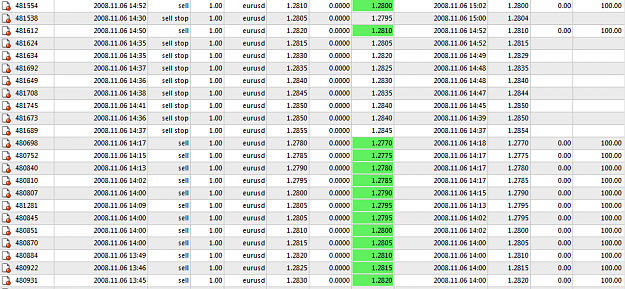

This is probably one of those "seemed like a good idea at the time" thoughts, but why not put a set of trade orders in the market at set intervals, with Take Profits at similar intervals, and just let the market run thru them like a row of Dominos?

The biggest problem that I have is taking profits; just never know when to get out, and this would seem to negate that problem as every trade would be pre-ordained.

And it seems to me that the goal of getting more pips would be easier solved by taking more contracts over shorter targets rather than trailing a stop on a single contract and going for the home run!

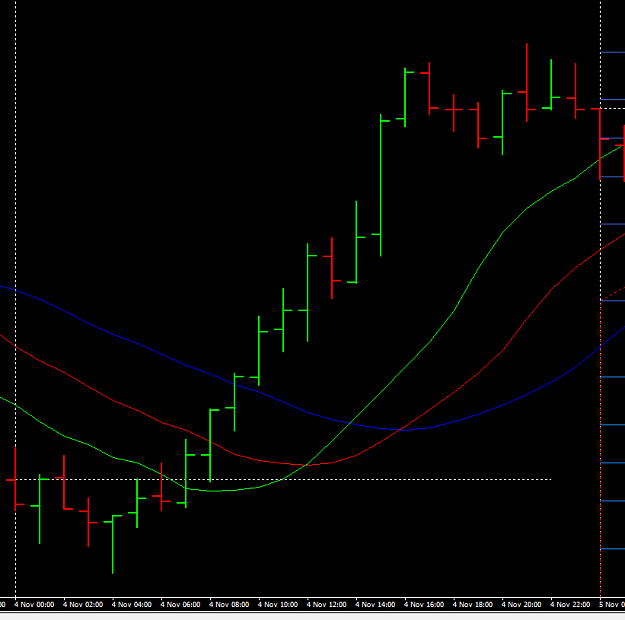

I guess this is a bit like the GRID trading that I have read about, except I would qualify it by saying just trade with the trend, especially when there is an overall powerful trend.

Any thoughts? Thanks, John

The biggest problem that I have is taking profits; just never know when to get out, and this would seem to negate that problem as every trade would be pre-ordained.

And it seems to me that the goal of getting more pips would be easier solved by taking more contracts over shorter targets rather than trailing a stop on a single contract and going for the home run!

I guess this is a bit like the GRID trading that I have read about, except I would qualify it by saying just trade with the trend, especially when there is an overall powerful trend.

Any thoughts? Thanks, John

Canadian by birth  Australian by choice

Australian by choice