( I am sure someone else is doing this but I came up with an Idea)

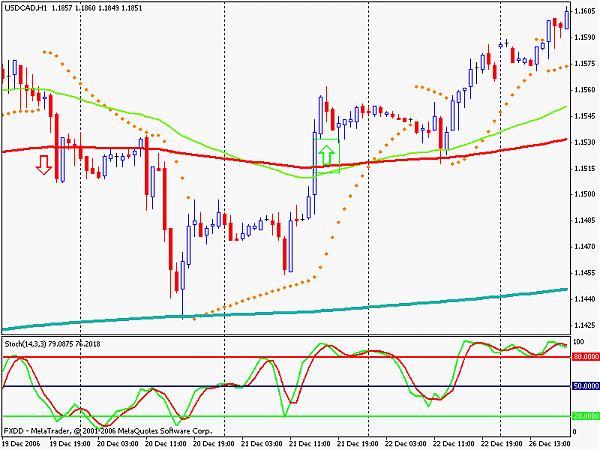

We start with the premise the 200 EMA closed

is equilibrium of the market on any chart

we use the 15 min chart as our bace chart

We put a 200 EMA (red) as our base line (15 min 200 EMA )

We put on a 67 ems (green) - to show the 200 on the 5 min chart

We put on a 800 ema (blue) to show the 200 on the 1 hour

We put on 3200 ema (purple) to show the 200 on the 4 chart

What can we do to trade

1. The watch dag

Use the 5 min 200 ema ( green) as a watch dog of up coming trades

- the price is going to far the wronge way

2. the price too far

& when the 15 min ema ( red) is out of place with the 2 higher time frames

we look to trade

- the price is to far & we can make some pips

3. the 1 & 4 hour 200 ema to show what should be the real price should be.

The trade is when ? we see the reversal happen - & a sign is?

3 possible ideas I have of when we trade

We start with the premise the 200 EMA closed

is equilibrium of the market on any chart

we use the 15 min chart as our bace chart

We put a 200 EMA (red) as our base line (15 min 200 EMA )

We put on a 67 ems (green) - to show the 200 on the 5 min chart

We put on a 800 ema (blue) to show the 200 on the 1 hour

We put on 3200 ema (purple) to show the 200 on the 4 chart

What can we do to trade

1. The watch dag

Use the 5 min 200 ema ( green) as a watch dog of up coming trades

- the price is going to far the wronge way

2. the price too far

& when the 15 min ema ( red) is out of place with the 2 higher time frames

we look to trade

- the price is to far & we can make some pips

3. the 1 & 4 hour 200 ema to show what should be the real price should be.

The trade is when ? we see the reversal happen - & a sign is?

3 possible ideas I have of when we trade

- we see a candle reverse

- &/or we use Par Sar as a buy sell signal - cross back

- &/or we see a crossing of the stoch - 14.3.3

We get out of the trade

1. We see a candle reverse

2. The Sar a sign

3. The Stoch crossed

4. The 15 min 200 comes back into place wiht hthe other higter frame lines

5. The 5 min 200 comes back into place with the other higher frame lines?

any Ideas - What do you think