This is in bone a Mean Reversion Strategy dressed in a Counter Trend Suit. Recommended pair is XAUUSD.

RULES RULES AND RULES.. FOLLOW THE RULES.

Let's get back to the business. This is in fact a scalping strategy that takes advantage of mean reversion. As you know price will retrace back to its average. What I do is find the most valid and highly accurate mean reverting entry area to scalp pips. My first and main objective is to gain some quick pips and close the position. I operate mainly on XAUUSD minute-5 time frame. I don't use or recommend higher time frame because price will deviate because of either fundamentals or sentiments or other issues. We don't want price to deviate before it works in our favor. Hence the minute 5. I will capture the most probabilistic movement and close out as soon as the high probabilistic movement is complete. That's the secret ingredient for me.

This works 90% of the time. I take a entry and take out few pips and close the position. But there comes times when things go south. This is when you need to understand the beast you are dealing with. Gold is extremely volatile as a pair. This is opportunity and challenge mixed together. You can take quick profit as well as suffer from strong trend.

In order to safe guard against a massive drawdown I maintain the following:

First, I make sure I have a huge balance. Gold has a daily avg movement of around 300 pips(i will assume high figure than usual so to expose my account to more risk than usual). but the good news is, price will not go against you 300 pips in a flick. It wil do the price action in between giving you handful of opportunites to scalp handful of pips.

Let's say due to Russia-Ukrain War gold price rise 2300 pips in an eye flick. This is impossible that price rise that much with an eye flick but we are creating this situation to create the worst case scenario.

rus-ukr war pips effect

feb 2300

if balance lot risked $ risked at 2300 pips % drawdown

cent account 1000c/10$ 0.03 690c/6.9$ 69%

standard acc 1,000$ 0.03 690$ 69%

If you notice, if you had a minimum of 10$ cent account, this highly unlikely but worst case would cost put you a drawdown of 690cent/6.9$ which is 69% drawdown. For standard account, assuming you have a 1000$ balance and a risk per trade is 0.03 lot, you would have less than 70% drawdown. Remember, this is an extremely impossible situation but still you will have 30% of your account balance safe.

To satisfy how safe this method is, have a look at the ATR of XAUUSD pair below. Note, I have increased the ATR value to a higher round figure to make it more risky to show you how safe this method is.

Cent 10$/ standard 1000$

ATR Lot 0.03 Drawdown

Daily 250 -75 -8%

Weekly 600 -180 -18%

Monthly 1500 -450 -45%

Let's assume price fall 250 pips in a eye flick which is daily avg for gold, it would be only 8% of your account. For 600 and 1500 pips would be -18% and -45% drawdown.

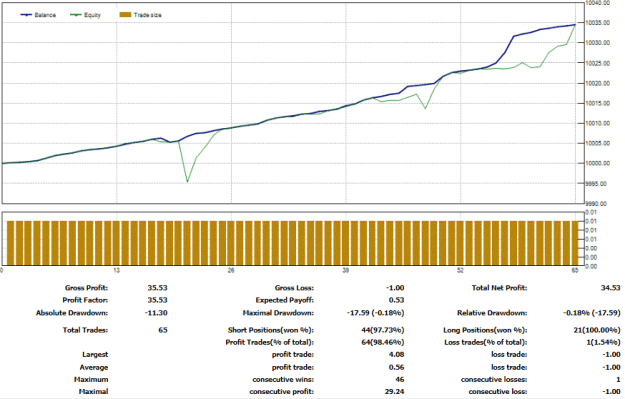

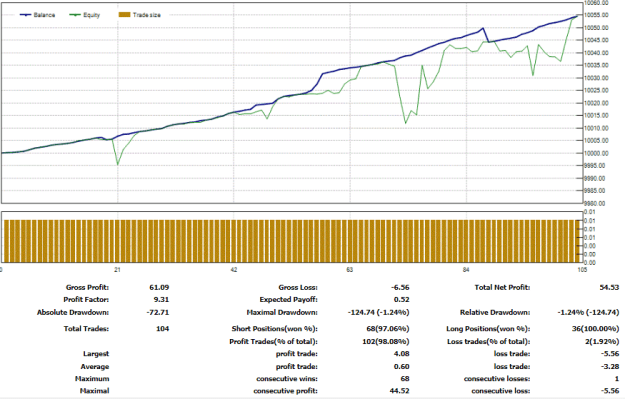

With years of backtest and forward testing, I have came up with a structure of the lot size per balance that is safe to use.

(cent/standard) For cent 1000 means 10$- for Standard 1000 means 1000$.

Lot Size

1000c/1000$ 0.03

1100 0.03

1400 0.04

1800 0.05

2200 0.06

2600 0.07

3000 0.08

3400 0.09

3800 0.10

4200 0.11

4600 0.12

5000 0.13

5400 0.14

5800 0.15

6200 0.16

6600 0.17

7000 0.18

7400 0.19

7800 0.20

8200 0.21

8600 0.22

9000 0.23

9400 0.24

10000 0.25

Now, remember we are in minute 5 time frame. We are counter trend scalping using highly accurate entry signals. My entries are so insanely accurate that my trades would work out 90% of time within a short span of time.

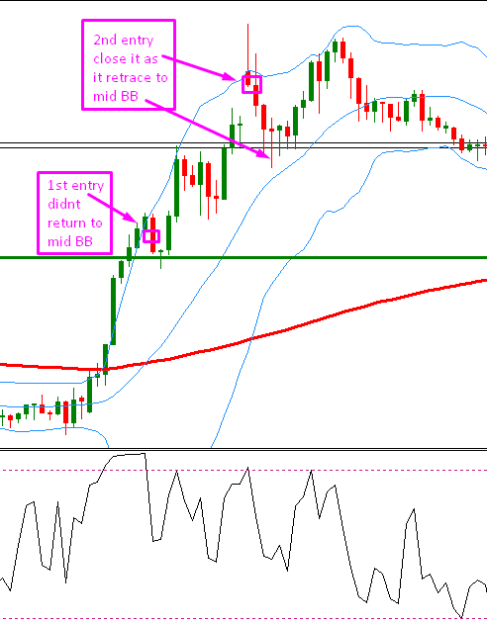

But know that there will come a time when the best entry will not work right away. After all you are trading against market and trend could be real strong that the strongest signals are not enough to withhold it. Hence come my 2nd rule, when my first entry doesn't work, I will add 2nd, 3rd or 4th positions but will close all of them when they retrace back to mid Bollinger bands. You heard me right. This is the new way of managing risk. When my first entry doesn't work right in short time and trend goes against me, I will let the first entry running but will close every new position that I have added on the same side of first entry and close them as soon as they retrace back to mid Bollinger band. See the picture below for a clear understanding.

As shown in the image above, first entry is a floating loss, but we add position as soon as 2nd signal appear and take profit as soon as it reaches mid BB. If we have kept both position running and have waited for the price to retrace back to our first entry, you might end up risking more if price went completely against us. You understand my point! So we not only add some extra profit by closing 2nd entry but also reduce the riskiness. This is the smart way of managing your RISK!!

Now the 3rd rule is if/when the other entry doesn't work but goes against you as well, This is when you need a very big balance and since you are risking only a small drop of that balance, you will be safe!! You have to make sure you only add positions at the highest possible retracement area and close every position that reaches mid BB.

Now you will surely ask me what is the highest possible retracement area and how do I figure them out. Hold your horse and read through:

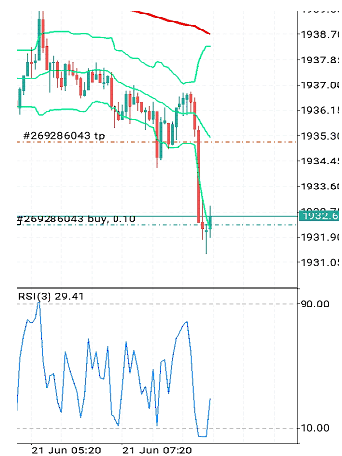

BUY ENTRY RULES:

Condition 1: Price must make a considerable distance from 200 EMA.

Condition 2: To count it as a buy zone, price must have to handsomely close below the lower bollinger band.

Condition 3: RSI(3) must be below 10

Condition 4: Price must have to retrace and then close above lower Bollinger band

Condition 5: Price must cross above RSI level 10

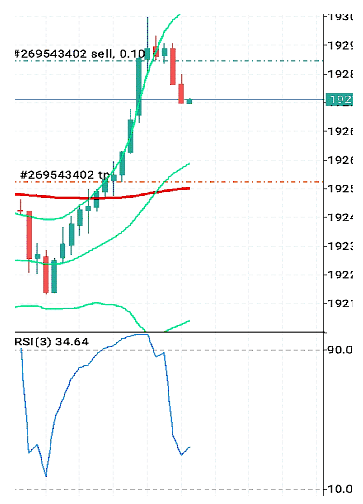

SELL ENTRY RULES:

Condition 1: Price must make a considerable distance from 200 EMA.

Condition 2: To count it as a sell zone, price must have to handsomely close above the upper Bollinger band.

Condition 3: RSI(3) must be above 90

Condition 4: Price must have to retrace and then close below upper Bollinger band

Condition 5: Price must cross below RSI level 90

--if all the conditions are met--

Place a buy order with the minimum lot size possible. Know that you have to place order with minimum lot size to safeguard against when it doesn't work.

Finally take profit when price hit mid Bollinger band. And as I have mentioned above, we don't use any stop loss but will add position when price goes against us.

Now what is the proper balance for this strategy?

This is a subjective question. But you can go as low as $10 for cent account and $1000 for standard account.

Note that, this is in bone a mean reversion strategy. As you know mean price sometimes rises exponentially. We only trade minute 5 chart to make sure price has the highest probability to return to our first entry. This way we are always 100% profitable!! However, the beast may turn against you in rarest cases. This can very well mean that price might not come back to your first entry price because the trend is extremely strong. This are the times you need experience and close out your first entry as soon as you see it coming close to your first entry or to an area that is comfortable. It might incur a small loss but the loss is worth it! You will have plenty of opportunity to recover that minor loss you took but holding onto it could incur a long term drawdown.

Final thoughts, once you have taken a Buy Entry, you can not take Sell entries until you close out your first Buy Entry.

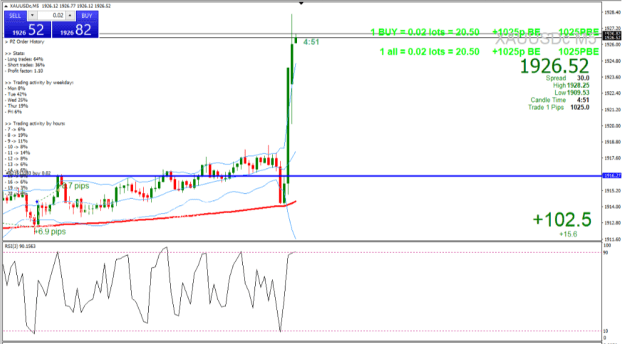

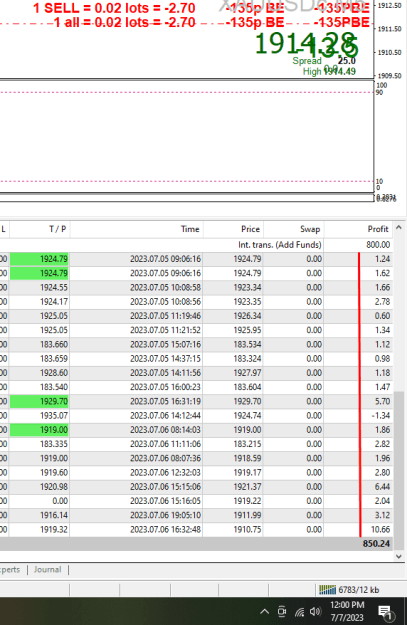

My terminal look something like this. Everything is attached!!

What it takes to trade this strategy:

- you need to keep an eye on your chart at a regular interval.

- you must always observe your open positions. Don't let them alone.

Good Luck & Happy trading!!

Recommended Broker: https://www.hfm.com/sv/?refid=376050

RULES RULES AND RULES.. FOLLOW THE RULES.

Let's get back to the business. This is in fact a scalping strategy that takes advantage of mean reversion. As you know price will retrace back to its average. What I do is find the most valid and highly accurate mean reverting entry area to scalp pips. My first and main objective is to gain some quick pips and close the position. I operate mainly on XAUUSD minute-5 time frame. I don't use or recommend higher time frame because price will deviate because of either fundamentals or sentiments or other issues. We don't want price to deviate before it works in our favor. Hence the minute 5. I will capture the most probabilistic movement and close out as soon as the high probabilistic movement is complete. That's the secret ingredient for me.

This works 90% of the time. I take a entry and take out few pips and close the position. But there comes times when things go south. This is when you need to understand the beast you are dealing with. Gold is extremely volatile as a pair. This is opportunity and challenge mixed together. You can take quick profit as well as suffer from strong trend.

In order to safe guard against a massive drawdown I maintain the following:

First, I make sure I have a huge balance. Gold has a daily avg movement of around 300 pips(i will assume high figure than usual so to expose my account to more risk than usual). but the good news is, price will not go against you 300 pips in a flick. It wil do the price action in between giving you handful of opportunites to scalp handful of pips.

Let's say due to Russia-Ukrain War gold price rise 2300 pips in an eye flick. This is impossible that price rise that much with an eye flick but we are creating this situation to create the worst case scenario.

rus-ukr war pips effect

feb 2300

if balance lot risked $ risked at 2300 pips % drawdown

cent account 1000c/10$ 0.03 690c/6.9$ 69%

standard acc 1,000$ 0.03 690$ 69%

If you notice, if you had a minimum of 10$ cent account, this highly unlikely but worst case would cost put you a drawdown of 690cent/6.9$ which is 69% drawdown. For standard account, assuming you have a 1000$ balance and a risk per trade is 0.03 lot, you would have less than 70% drawdown. Remember, this is an extremely impossible situation but still you will have 30% of your account balance safe.

To satisfy how safe this method is, have a look at the ATR of XAUUSD pair below. Note, I have increased the ATR value to a higher round figure to make it more risky to show you how safe this method is.

Cent 10$/ standard 1000$

ATR Lot 0.03 Drawdown

Daily 250 -75 -8%

Weekly 600 -180 -18%

Monthly 1500 -450 -45%

Let's assume price fall 250 pips in a eye flick which is daily avg for gold, it would be only 8% of your account. For 600 and 1500 pips would be -18% and -45% drawdown.

With years of backtest and forward testing, I have came up with a structure of the lot size per balance that is safe to use.

(cent/standard) For cent 1000 means 10$- for Standard 1000 means 1000$.

Lot Size

1000c/1000$ 0.03

1100 0.03

1400 0.04

1800 0.05

2200 0.06

2600 0.07

3000 0.08

3400 0.09

3800 0.10

4200 0.11

4600 0.12

5000 0.13

5400 0.14

5800 0.15

6200 0.16

6600 0.17

7000 0.18

7400 0.19

7800 0.20

8200 0.21

8600 0.22

9000 0.23

9400 0.24

10000 0.25

Now, remember we are in minute 5 time frame. We are counter trend scalping using highly accurate entry signals. My entries are so insanely accurate that my trades would work out 90% of time within a short span of time.

But know that there will come a time when the best entry will not work right away. After all you are trading against market and trend could be real strong that the strongest signals are not enough to withhold it. Hence come my 2nd rule, when my first entry doesn't work, I will add 2nd, 3rd or 4th positions but will close all of them when they retrace back to mid Bollinger bands. You heard me right. This is the new way of managing risk. When my first entry doesn't work right in short time and trend goes against me, I will let the first entry running but will close every new position that I have added on the same side of first entry and close them as soon as they retrace back to mid Bollinger band. See the picture below for a clear understanding.

As shown in the image above, first entry is a floating loss, but we add position as soon as 2nd signal appear and take profit as soon as it reaches mid BB. If we have kept both position running and have waited for the price to retrace back to our first entry, you might end up risking more if price went completely against us. You understand my point! So we not only add some extra profit by closing 2nd entry but also reduce the riskiness. This is the smart way of managing your RISK!!

Now the 3rd rule is if/when the other entry doesn't work but goes against you as well, This is when you need a very big balance and since you are risking only a small drop of that balance, you will be safe!! You have to make sure you only add positions at the highest possible retracement area and close every position that reaches mid BB.

Now you will surely ask me what is the highest possible retracement area and how do I figure them out. Hold your horse and read through:

BUY ENTRY RULES:

Condition 1: Price must make a considerable distance from 200 EMA.

Condition 2: To count it as a buy zone, price must have to handsomely close below the lower bollinger band.

Condition 3: RSI(3) must be below 10

Condition 4: Price must have to retrace and then close above lower Bollinger band

Condition 5: Price must cross above RSI level 10

SELL ENTRY RULES:

Condition 1: Price must make a considerable distance from 200 EMA.

Condition 2: To count it as a sell zone, price must have to handsomely close above the upper Bollinger band.

Condition 3: RSI(3) must be above 90

Condition 4: Price must have to retrace and then close below upper Bollinger band

Condition 5: Price must cross below RSI level 90

--if all the conditions are met--

Place a buy order with the minimum lot size possible. Know that you have to place order with minimum lot size to safeguard against when it doesn't work.

Finally take profit when price hit mid Bollinger band. And as I have mentioned above, we don't use any stop loss but will add position when price goes against us.

Now what is the proper balance for this strategy?

This is a subjective question. But you can go as low as $10 for cent account and $1000 for standard account.

Note that, this is in bone a mean reversion strategy. As you know mean price sometimes rises exponentially. We only trade minute 5 chart to make sure price has the highest probability to return to our first entry. This way we are always 100% profitable!! However, the beast may turn against you in rarest cases. This can very well mean that price might not come back to your first entry price because the trend is extremely strong. This are the times you need experience and close out your first entry as soon as you see it coming close to your first entry or to an area that is comfortable. It might incur a small loss but the loss is worth it! You will have plenty of opportunity to recover that minor loss you took but holding onto it could incur a long term drawdown.

Final thoughts, once you have taken a Buy Entry, you can not take Sell entries until you close out your first Buy Entry.

My terminal look something like this. Everything is attached!!

What it takes to trade this strategy:

- you need to keep an eye on your chart at a regular interval.

- you must always observe your open positions. Don't let them alone.

Good Luck & Happy trading!!

Recommended Broker: https://www.hfm.com/sv/?refid=376050

Attached File(s)

Protect your capital