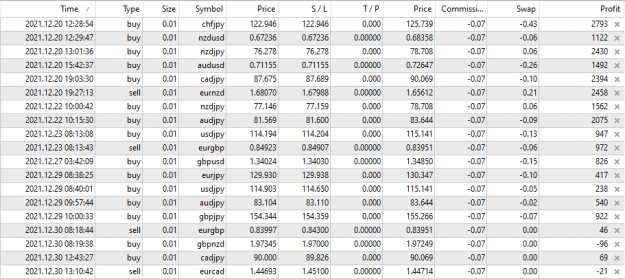

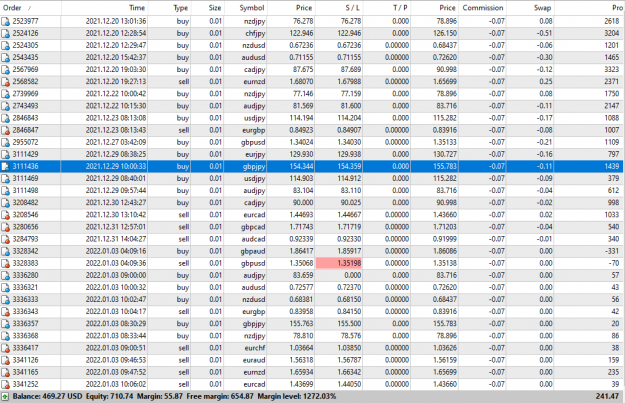

The account equity jumped up as Nasdaq and SP500 moved up recently. +130% up since the beginning of this thread and I am not even trading actively...

That is the beauty of building equity. I hope you are enjoying the ride.

That is the beauty of building equity. I hope you are enjoying the ride.

2