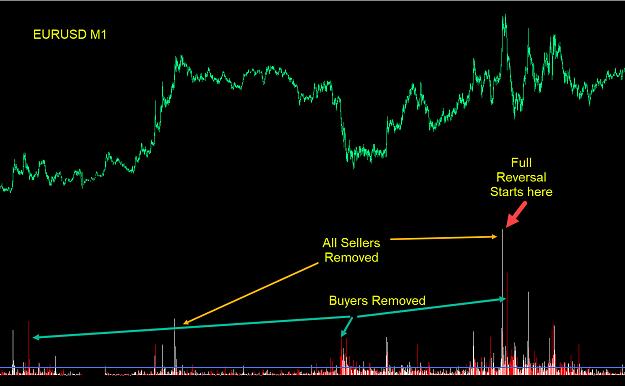

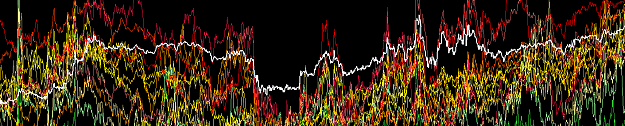

Disliked{quote} Wow, looks like a great generation of targeted shift with volume, on a general note, we can see volume in it's rawest form but need to decipher buying and selling, our only tell is probability of trend, can see from the off this is going to be interesting, thanks Lekkim, DIgnored

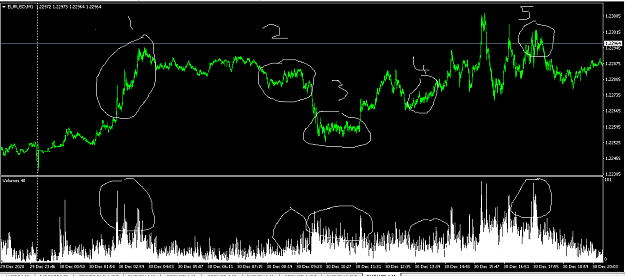

1