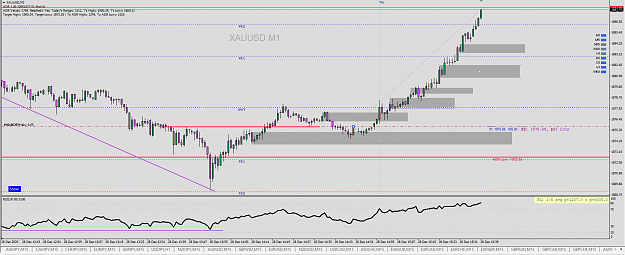

Literally out of control

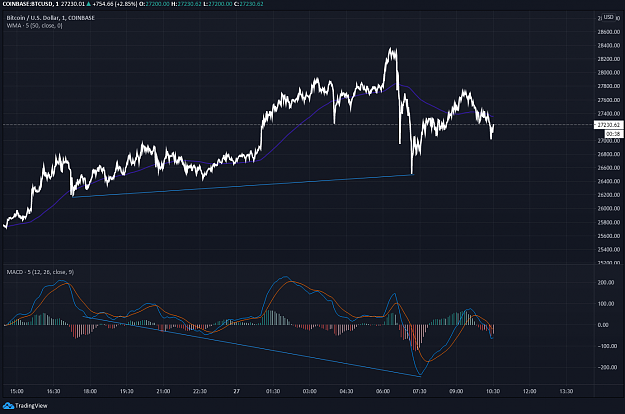

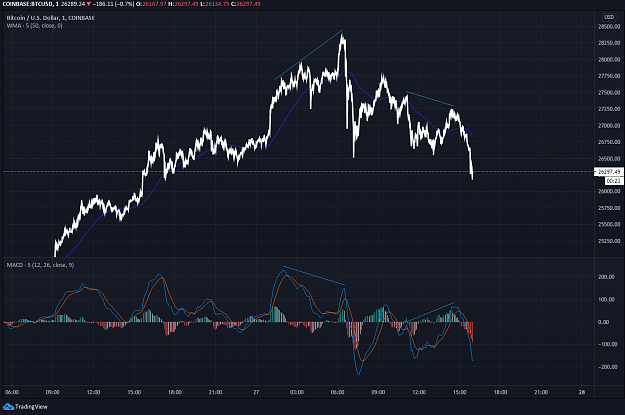

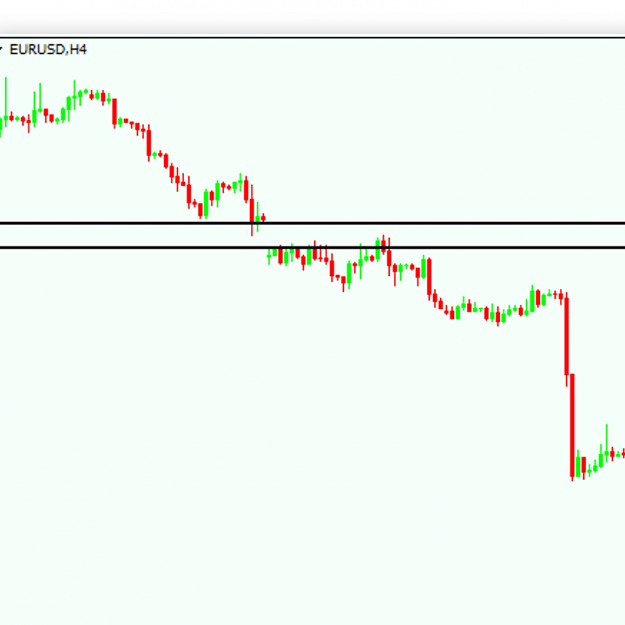

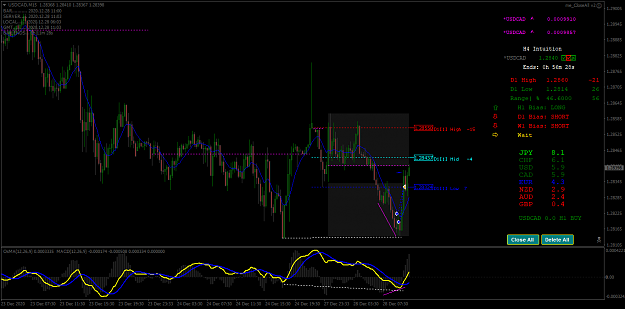

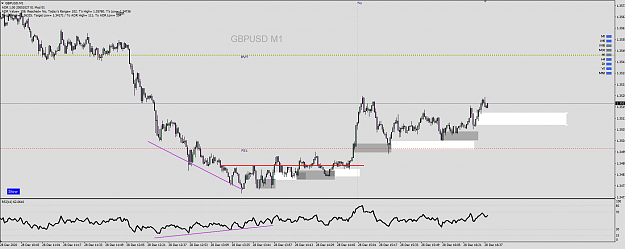

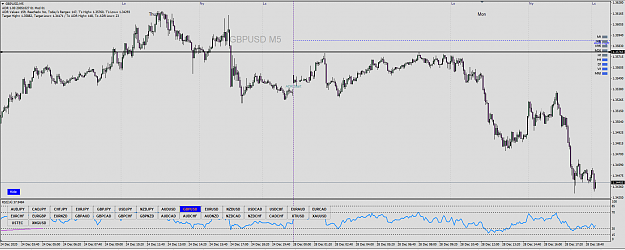

2021 I’m trading this full time. With the amount of volume on a daily basis makes trading forex boring. Still gonna trade GBP pairs but on weekends and holidays. I could of been really killing it now. I just need to find a broker that has a reasonable spread on BTC

2021 I’m trading this full time. With the amount of volume on a daily basis makes trading forex boring. Still gonna trade GBP pairs but on weekends and holidays. I could of been really killing it now. I just need to find a broker that has a reasonable spread on BTC

2