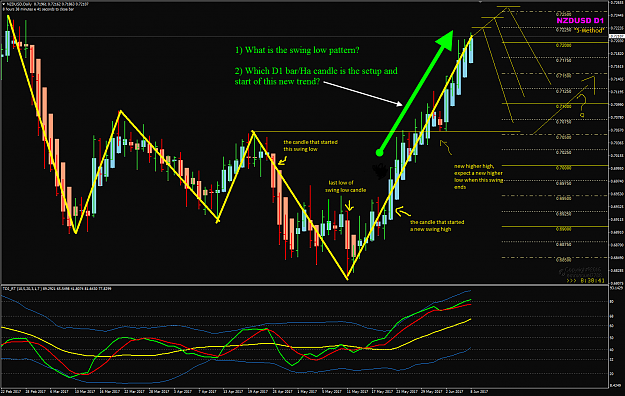

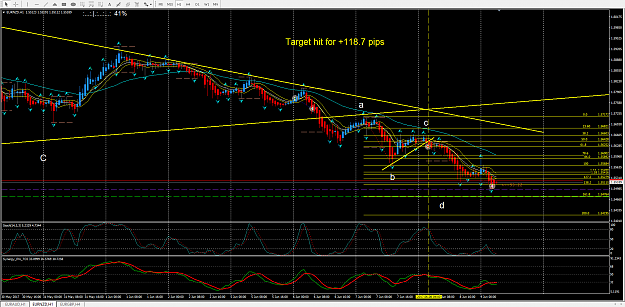

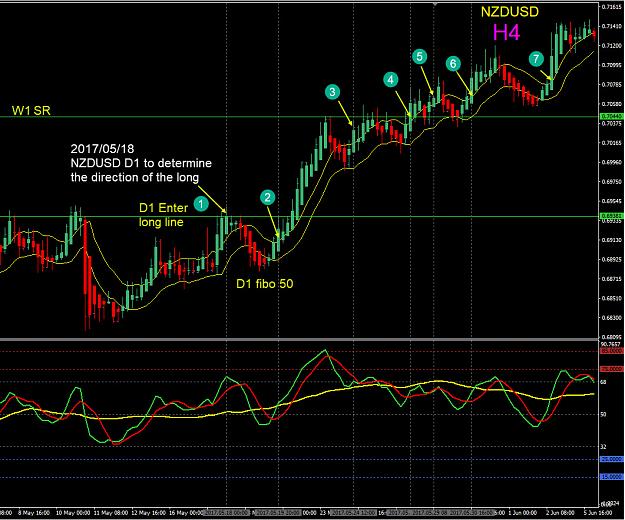

Disliked{quote} NZDUSD Week 23 June 7 trades update: Move trailing SL to below yesterday's Low since today made a Higher High but the day has not closed yet. Most likely I will close all trades tomorrow. {image}Ignored

- Post #80,143

- Quote

- Jun 8, 2017 9:52am Jun 8, 2017 9:52am

Do not understand English, forgive me with google translation

- Post #80,144

- Quote

- Jun 8, 2017 11:58am Jun 8, 2017 11:58am

- Joined Sep 2015 | Status: ob-la-di, ob-la-da, life goes on... | 4,006 Posts

Since Frank Sinatra sings in his own way, my chart sing... I did it, my way

- Post #80,146

- Quote

- Jun 8, 2017 7:19pm Jun 8, 2017 7:19pm

- Joined Dec 2006 | Status: PipMaster in Training.... | 98 Posts

- Post #80,147

- Quote

- Jun 8, 2017 7:59pm Jun 8, 2017 7:59pm

- Joined Nov 2008 | Status: Member | 45,219 Posts

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

- Post #80,148

- Quote

- Jun 8, 2017 8:18pm Jun 8, 2017 8:18pm

- Joined Nov 2008 | Status: Member | 45,219 Posts

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

- Post #80,149

- Quote

- Jun 8, 2017 8:27pm Jun 8, 2017 8:27pm

- Joined Sep 2015 | Status: ob-la-di, ob-la-da, life goes on... | 4,006 Posts

Since Frank Sinatra sings in his own way, my chart sing... I did it, my way

- Post #80,150

- Quote

- Jun 8, 2017 8:49pm Jun 8, 2017 8:49pm

- Joined Nov 2008 | Status: Member | 45,219 Posts

Honesty is a very expensive gift. You wont find it in cheap people.WBuffett

- Post #80,151

- Quote

- Jun 8, 2017 9:06pm Jun 8, 2017 9:06pm

- Joined Sep 2015 | Status: ob-la-di, ob-la-da, life goes on... | 4,006 Posts

Since Frank Sinatra sings in his own way, my chart sing... I did it, my way

- Post #80,153

- Quote

- Edited 10:15pm Jun 8, 2017 9:18pm | Edited 10:15pm

- Joined Sep 2015 | Status: ob-la-di, ob-la-da, life goes on... | 4,006 Posts

Since Frank Sinatra sings in his own way, my chart sing... I did it, my way

- Post #80,155

- Quote

- Jun 9, 2017 2:34am Jun 9, 2017 2:34am

Do not understand English, forgive me with google translation

- Post #80,157

- Quote

- Jun 9, 2017 3:38am Jun 9, 2017 3:38am

Do not understand English, forgive me with google translation

- Post #80,158

- Quote

- Jun 9, 2017 8:21am Jun 9, 2017 8:21am

- Joined Jun 2013 | Status: Membership Rewarded | 3,178 Posts

Risiko birgt immer auch die Chance.