DislikedHi,

New to Forex. Been following the thread for a while. Wanted to ask RealJumper if you have different settings for the extreme indicator on m1 charts. I seem to have very few spikes on m1. Significantly less than that on the m5.Ignored

You can only trade the M1 charts when the PA is suitable. Sometimes the M5 charts are un-tradable, especially when the PA is in a tight range, and the M1 charts see that same PA is easy to trade. Sometimes the M1 is untradable.......it all depends.

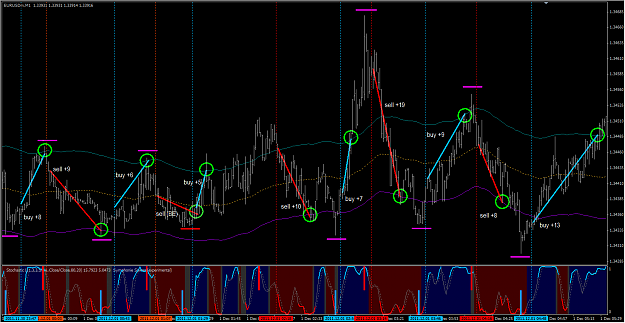

I wouldn't, and don't make a habit of trading M1 charts, I just do it when M5 won't give up any pips but M1 will........10 trades of 8 pips average is 80 pips!!!

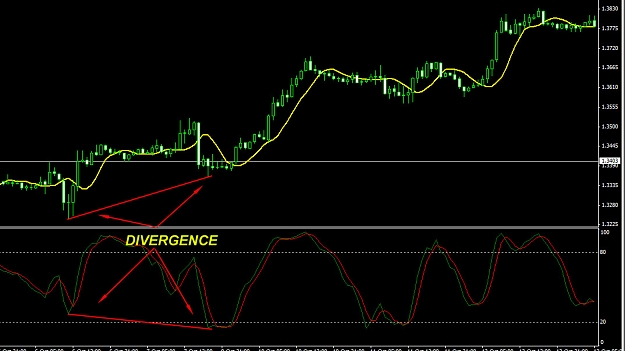

The spikes on the M1 are certainly helpful, but for me, the secret lays in the stochastic. If I could only ever have one indicator, I would choose the stochastic.

Everything you need for M1 trading is here

Doing what you like is Freedom. Liking what you do is Happiness.