That's why you must know when to stop,stop loss.

And money isn't dumb,money is a object and objects don't have feelings.

But i see what you trying to say.

Work smarter,not harder

1

Rags to Riches 21 replies

Rags To Riches 203 replies

rags to more rags.. and even more rags! 19 replies

Rags to rags and ice cream 36 replies

Rags To Riches Take 2 24 replies

DislikedHi.just want to ask.why i cant private message any other forum users?Ignored

DislikedI came across this very interesting thread. Is the original poster still around? I pulled the following from the Post # 1. Can someone explain this in more details. Based on the following it seems like as long as you make 9 Total wins...you will make 100,000% gain. The original poster has shown example that out of 150 trades taken, even if you win 9 trades and lose 141 trades, you still make 100,000% gains. How is this possible? Can someone please explain with examples? 5) 9 NWT = 100,000% Gain If you have 9 Net Winning Trades, scaling up after...Ignored

DislikedYou need to read the thread. I found it very interesting. The summary is this: you risk 50% of your trading account to make 100% and just keep going. If you lose you risk the same of the new account balance. The author recommends starting with a very small amount that you can afford to lose so that you can try and try again to gain tractionIgnored

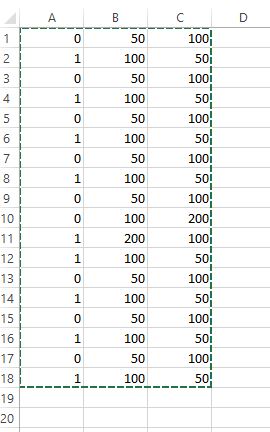

DislikedI attempted this on a spreadsheet to help understand. It shows 18 trades. 9 out of them are winners which makes 100% and 9 are losers that loses 50%. In this example I do not end up with 100,000% returns. I am more or less at the original balance {image}Ignored

DislikedThe original poster has shown example that out of 150 trades taken, even if you win 9 trades and lose 141 trades, you still make 100,000% gains. How is this possible?Ignored

Disliked{quote} the need isn't to have 9 wins ... but 9 NET wins ... meaning 9 wins more than the losses.Ignored

Disliked{quote} Basically put, at some point your going to have to have a strategy that wins greater than 50% of the time if your are trying this at a 1:2 risk/reward ratio. That being said, I think the math in your spreadsheet is wrong. Here is how I see it... Start balance $50 Trade 1: Win, risked $25 for $100 reward, new balance $150 Trade 2: Loss, risked $75 for $300 reward. new balance $75 Trade 3: Win, risked $37.50 for $150 reward, new balance $225 Trade 4: Loss, risked $112.50 for $450 reward, new balance $ 112.50 Trade 5: Win, risked $56.25 for...Ignored

DislikedYes FerruFx you're right. I wanna say to everybody even by using "free" money (by the high amount of leverage) this doesn't mean it is risk free. You might all think that the SL will save you but you never know what might happen to the market. As long as there is no big unstoppable movement then sure you can consider it "free". By big unstoppable movement I am talking about for example 15 january 2015. The market moved about 2000 pips (CHF pairs). In cases like these the SL can or cannot trigger and it can leave you a negative balance that you need...Ignored

Disliked{quote} Basically put, at some point your going to have to have a strategy that wins greater than 50% of the time if your are trying this at a 1:2 risk/reward ratio. That being said, I think the math in your spreadsheet is wrong. Here is how I see it... Start balance $50 Trade 1: Win, risked $25 for $100 reward, new balance $150 Trade 2: Loss, risked $75 for $300 reward. new balance $75 Trade 3: Win, risked $37.50 for $150 reward, new balance $225 Trade 4: Loss, risked $112.50 for $450 reward, new balance $ 112.50 Trade 5: Win, risked $56.25 for...Ignored

DislikedKeep risk fixed at 1% of account balance try to collect whatever pips you get [ new girl each trade ] the balance compounds over time with limited risk get greedy, risk over `1% and you get stuck in a manhole your account, you decide , lolIgnored