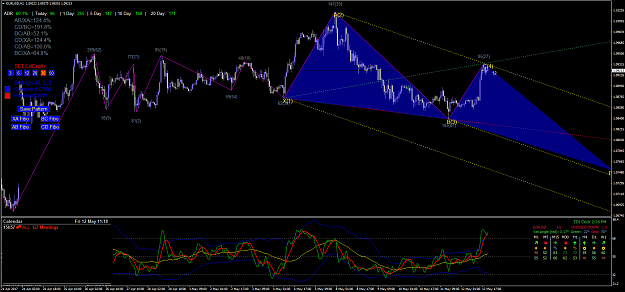

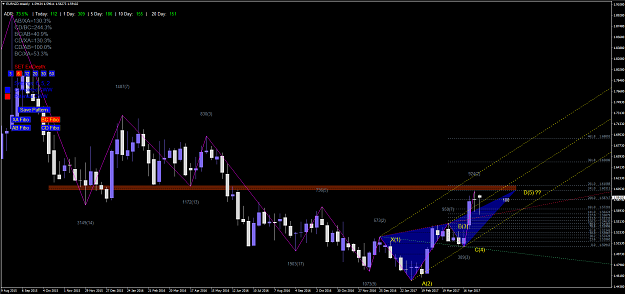

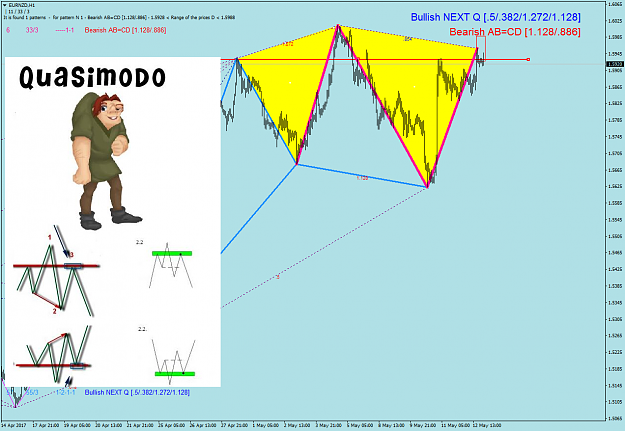

EURUSD 6H Renko [25 pip] Chart CWW:

The orange text maps out the correction.

The CWW has that over balanced look at D[5].

[I remember that being important from my previous WW days]

Cheers, U2

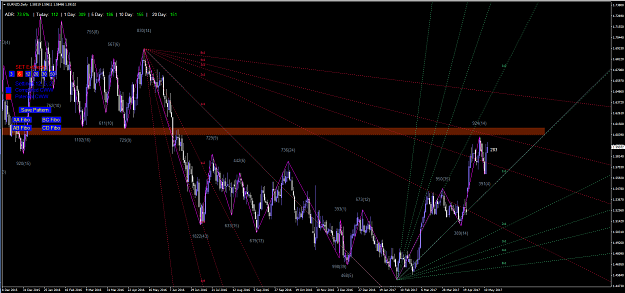

The orange text maps out the correction.

The CWW has that over balanced look at D[5].

[I remember that being important from my previous WW days]

Cheers, U2

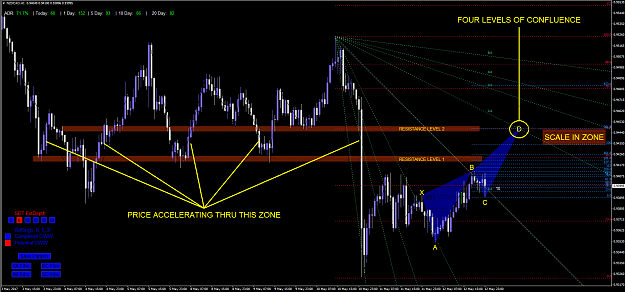

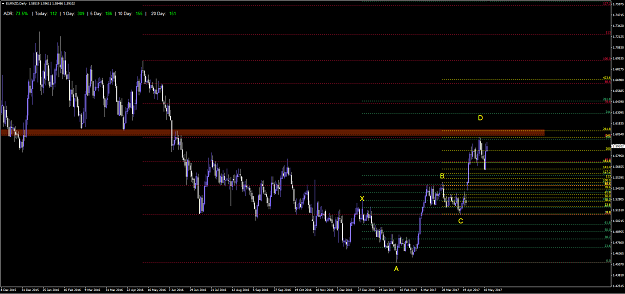

Wait, or you will be slaughtered!

1

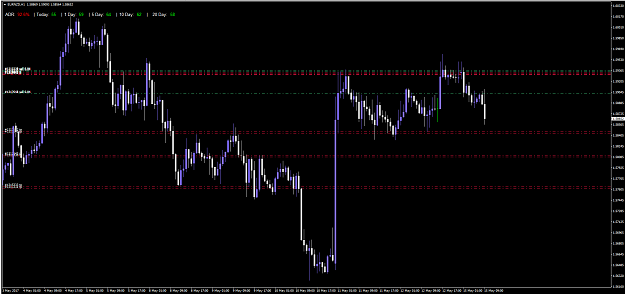

![Click to Enlarge

Name: EURUSD 170512 6H [1] WW.png

Size: 94 KB](/attachment/image/2307044/thumbnail?d=1494598748)