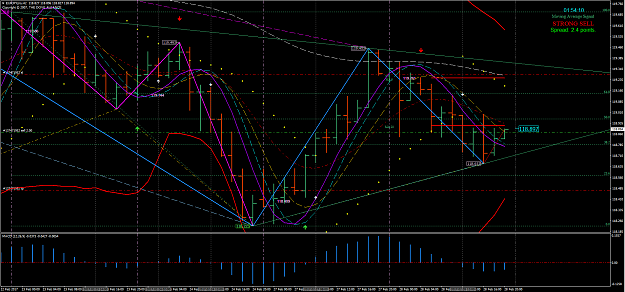

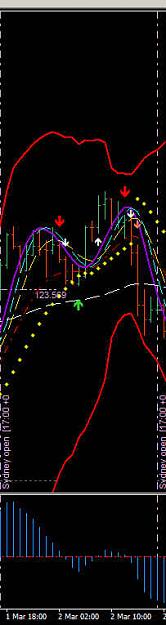

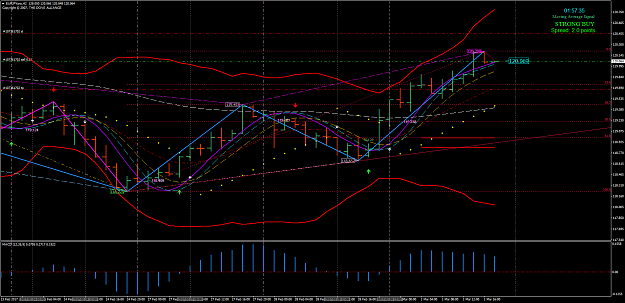

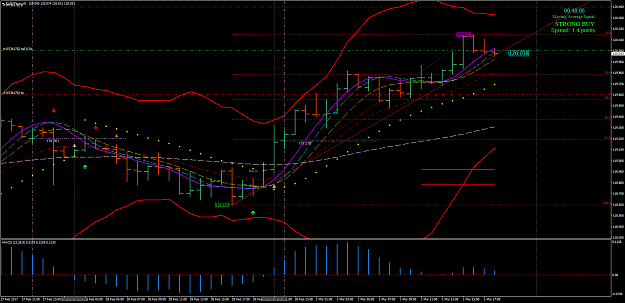

Disliked{quote}{quote} OK Oli - Your trade was right on target for the short. What was impressive is you waiting for the open candle below ROMAR resistance. What made your entry excellent is the confluence with the Divergence on the H2; the 23..6 resistance of the Daily; and also the Smooth resistance on the Daily for the short. So because of confluence there was "0" risk. As for the SAR - that would had been a bad trade because the SAR was on the same side of the Parabolic - which means the DB would attached for the continuance of the downtrend.Ignored

I must admit i was not looking at the divergence as a point of reference during the trade as i am still studying this particular aspect of the system and how it all falls into place. So to be honest, from the divergence and my lack of understanding it - your reference to divergence was a complete accident on my part despite noticing they were there. I understand this to mean we increase our risk by not being properly educated in this regard & i'll strive to do better. There are numerous posts related to divergence and how to use it for which we all can better understand. Thanking you.

Thank you for clearing up about my question if I had gone Long - That makes complete sense to me now.

Thank you Shaun for your recent responses as well. Much appreciated.

If you make up your own rules then the story is sad.....