Hello Everyone,

Are there anybody can help me to fix this indicator and expert? The expert "sRs_Trade_Management_Robot" and the indicator "sRs_Trend_Rider_Alert" can't attach into chart. I bought it form reseller. If someone would like to share the original, I would be appreciate.

Thank you before.

Are there anybody can help me to fix this indicator and expert? The expert "sRs_Trade_Management_Robot" and the indicator "sRs_Trend_Rider_Alert" can't attach into chart. I bought it form reseller. If someone would like to share the original, I would be appreciate.

Thank you before.

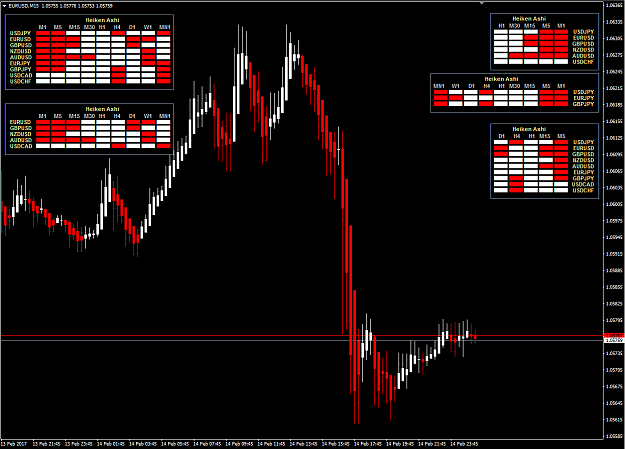

Attached File(s)